Sell more, however your customers shop.

Seamlessly blend brick-and-mortar with ecommerce when you unlock Buy Online, Pick Up In Store (BOPIS) functionality on BigCommerce.

Enabling Customers to Pay With Venmo: Your New Payment (+ Millennial) Gateway to Boosted Conversion

Enabling Customers to Pay With Venmo: Your New Payment (+ Millennial) Gateway to Boosted Conversion

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

Convenience is everything. Without it, consumers have no reason to do business with a brand.

There are many ways to add convenience to your customers’ lives. In today’s post, we’re not talking about buzzwords like variety or customization… we’re talking about smart payments — specifically, the advantages Venmo can bring to your ecommerce store.

Simply put, Venmo is a mobile payment method that allows consumers to pay and request money from friends and family, or use the payment option to pay on mobile web with authorized merchants.

Since PayPal acquired Venmo, the mobile app has experienced fast, exponential growth — with more than 40 million active accounts.

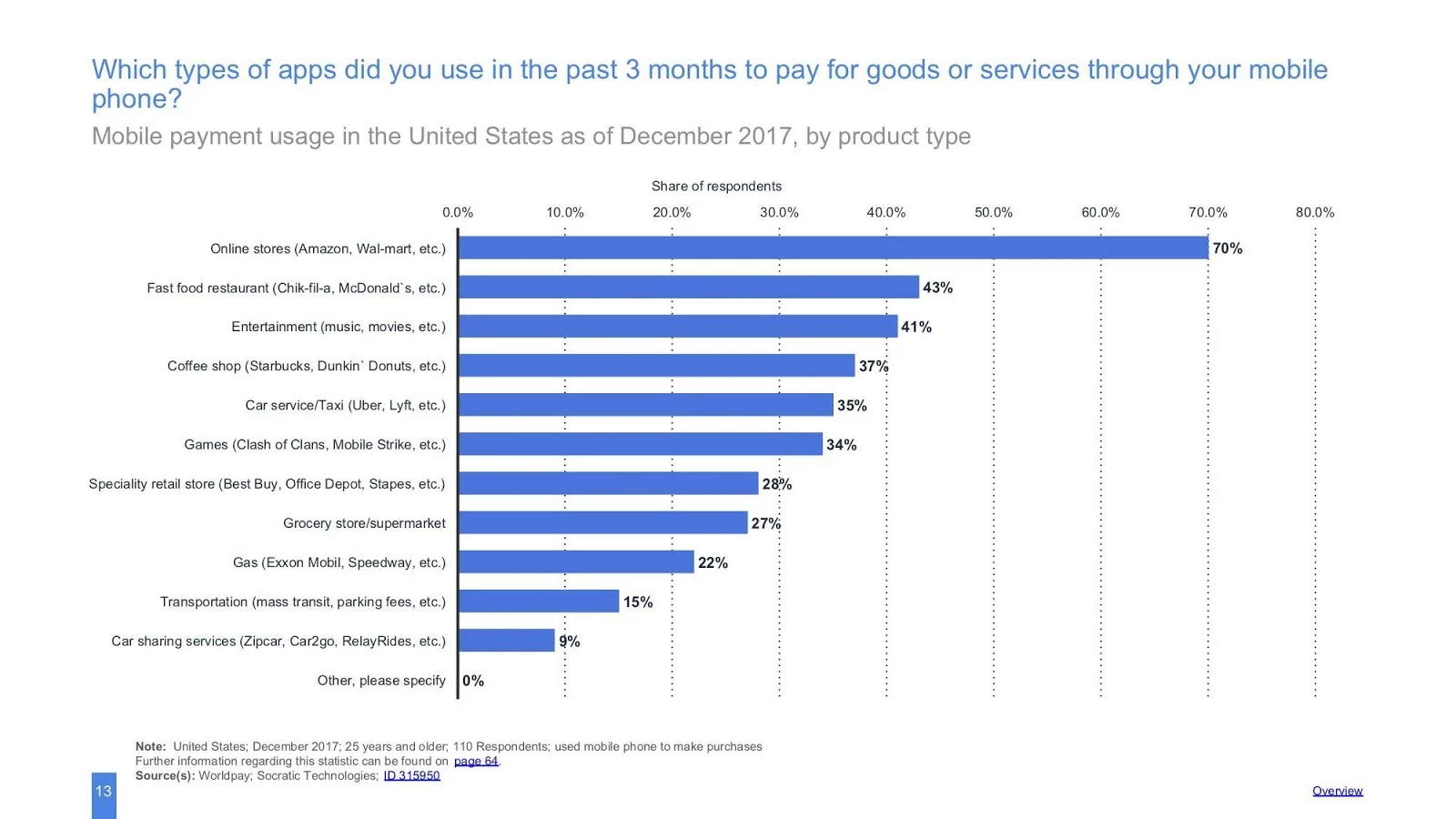

A recent study found that the top place consumers want functionality to use smart or mobile payments are on online stores. Popular brick-and-mortar locations like fast food restaurants, entertainment (think concert tickets), and coffee shops follow.

Your business may already accept generic credit card or debit card payments, or even Apple Pay. Discover what PayPal Checkout with Smart Payment Buttons — like payments with Venmo — could do for your online store.

Overview of Venmo: Who Uses It + How It Works

Venmo is a digital wallet which initially became popular among those who were looking for an easier way to make and share payments with friends or family.

Here are a few examples of use cases that aided Venmo’s growth:

Splitting a dinner bill (especially when the waiter says they don’t do separate checks).

Paying your roommate your half of the utilities or rent.

Surprising a friend by sending them money to buy a morning coffee.

How Does Venmo Work?

So, how exactly can you manage peer-to-peer payments from your mobile device using Venmo?

It’s actually very simple.

After creating a Venmo account and linking it to your bank account, you’re ready to accept or send payments!

Similar to a PayPal account, where users have options on how to send, spend or transfer their balance, Venmo users can do the same. Venmo users can send money to friends or family, spend the money in their account using the Venmo Mastercard, shop at the millions of merchants that accept Venmo or transfer the balance in their Venmo account to an eligible debit card or U.S. bank account.

As Venmo becomes an increasingly popular way for consumers to transact with one another, it’s important for your online business to strategize how to introduce this payment method to your store functionality.

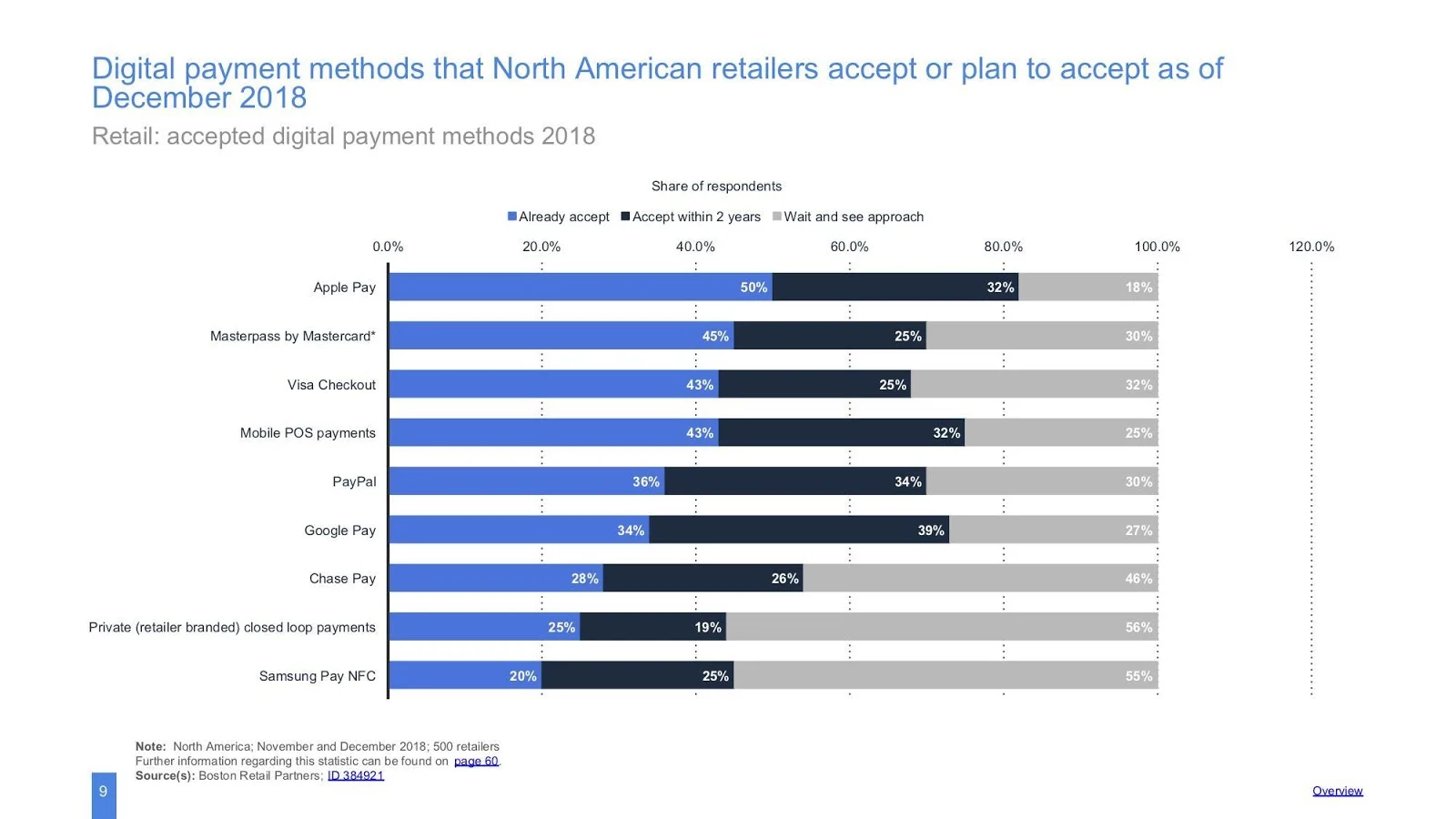

In fact, a majority of North American retailers already or plan to accept mobile POS payments within the next two years.

PayPal merchants are already one step ahead.

With PayPal Checkout with Smart Payment Buttons or the Braintree payment platform, customers are only one step away from using their favorite mobile payment option.

Who Uses Venmo?

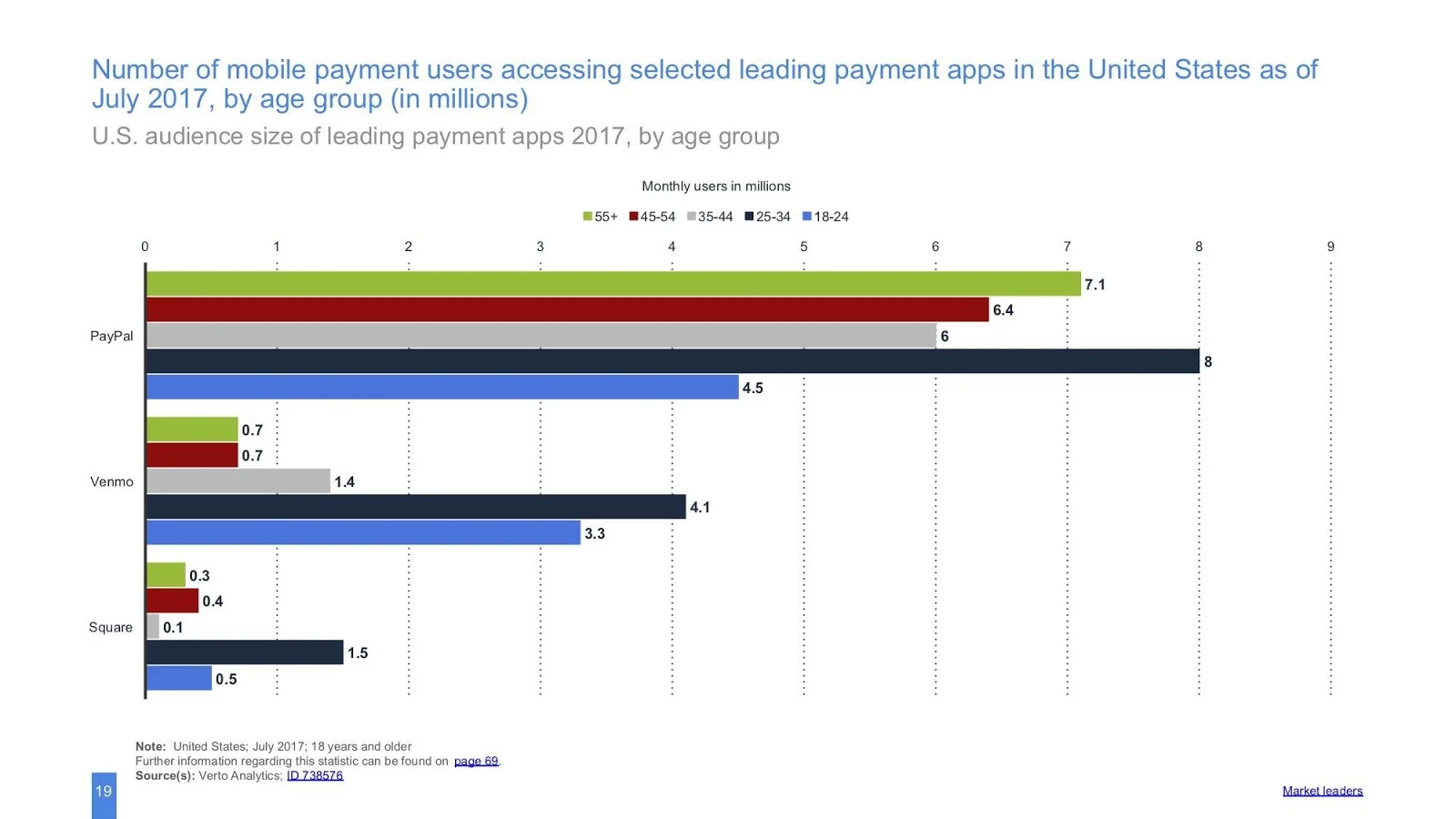

Venmo users cover a wide range of demographics, but their largest concentration of users is millennials.

There are a few reasons why Venmo is so popular with millennials.

The first reason is that Venmo is a digitally savvy payment option that allows users to transact across multiple mediums: the Venmo app (both on iPhone and Android), merchant payments or PayPal Express Checkout, business accounts, and more.

Venmo was also the first app to personalize peer-to-peer payments. How so? Users can send a message with their payments (that can be made private or public to friends), which often include an array of emojis and funny notes to friends and family.

Check out this video to see how people are communicating with emojis on Venmo.

https://www.youtube.com/watch?v=QMvfm-GRMD4

Benefits of Allowing Customers to Pay With Venmo on Ecommerce Sites

We’ve gone through the basics of what Venmo is, how it works and who uses it. The next step is understanding why your online store should introduce the payment option. Lucky for both your online business and your customers, introducing Venmo comes with many benefits.

1. Reduce cart abandonment and boost conversion.

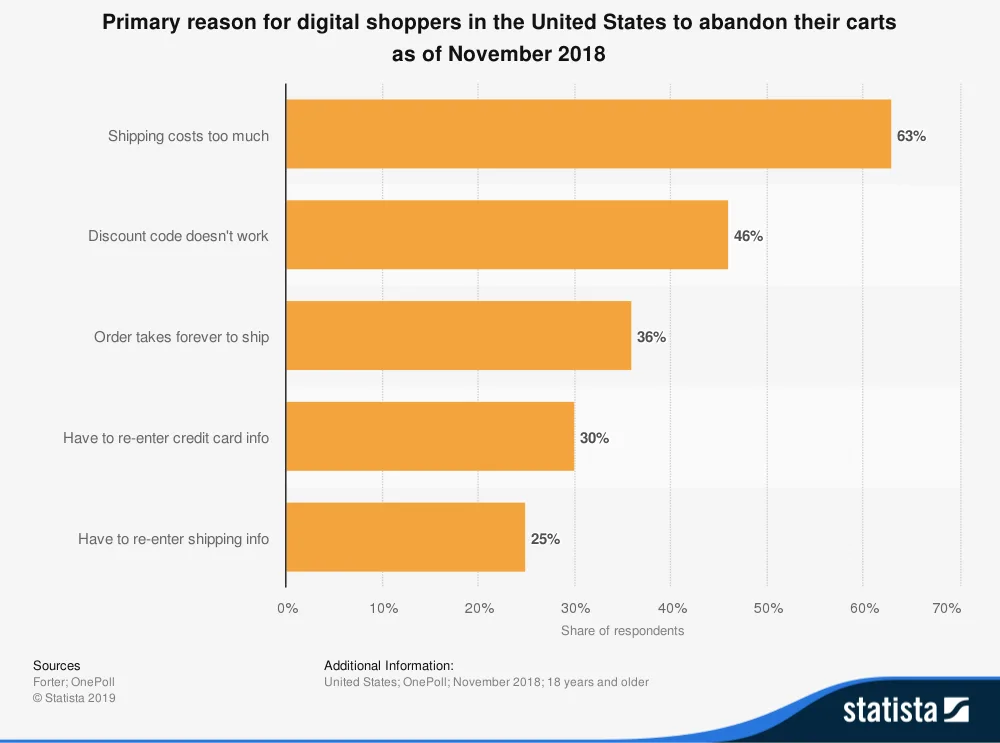

Customers abandon their carts for various reasons, but a recent survey may surprise you.

In 2018, 30% of U.S. shoppers abandoned their carts because they had to re-enter payment information.

Yikes — that’s a ton of lost sales. By implementing the ability to pay with Venmo, your customers won’t need to re-enter payment information that’s already in their Venmo account.

2. More consumers are using Venmo.

When you think about your payment option strategy, you want to look at the trends.

Ask yourself, what payment options are important to your customers? What payment methods will they be using in the next two years? Five years?

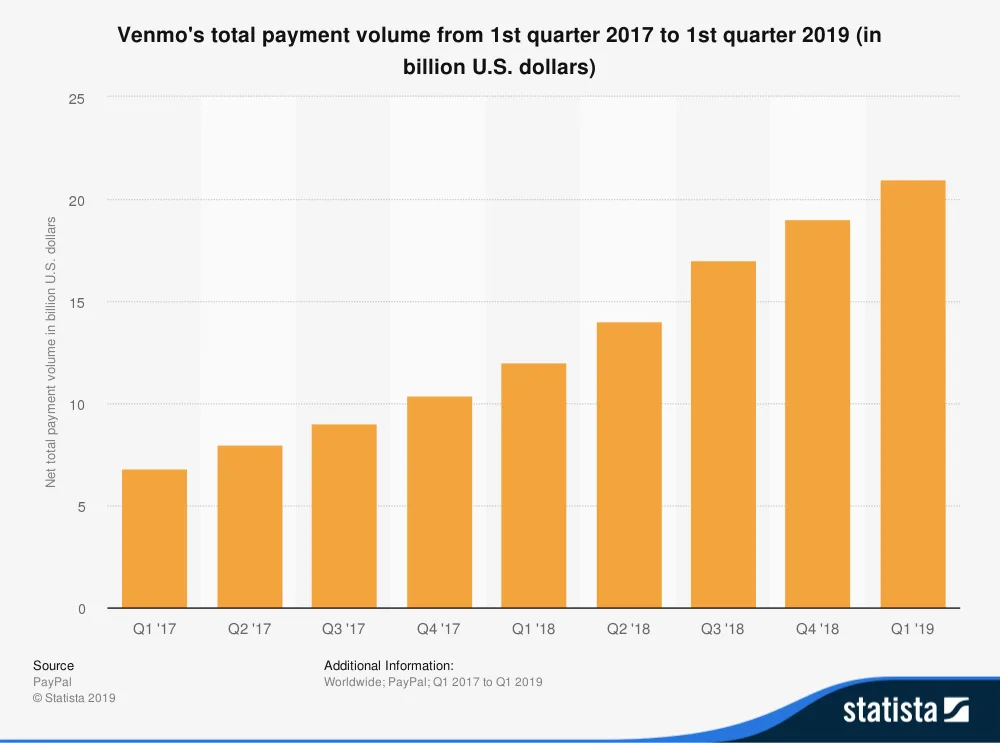

From Q1 2017 to Q1 2019, Venmo has grown their total payment volume from $6.8 billion to $21 billion. That’s a heavy uplift in transactions.

By integrating a growing payment method, your business stays ahead of the curve and is seen as a more reputable brand to transact with.

3. Reach more millennial shoppers.

Introducing Venmo enables you to connect with a highly engaged audience.

The mobile payment app is the most used by millennials and, on average, their most engaged users check it two to three times per week.

This will not only allow your online store to offer a great payment option to your customers, but will generate valuable exposure for your brand. When purchasing items with Venmo, users can choose to share their purchases in their social feeds.

4. Access to PayPal Marketing Solutions.

So far, we’ve covered how offering the ability to pay with Venmo on your site can help you reduce cart abandonment and boost conversion. Now it’s time to focus on average order value (AOV).

If you’re going to have higher conversion, it would be a double win to increase AOV along with it. Luckily, by offering PayPal Smart Payment Buttons, you’ll get access to PayPal Marketing Solutions.

PayPal Marketing Solutions helps businesses increase sales by providing greater insight into their customer base across a variety of channels.

A few notable features:

Shopper Insights: Discover aggregated and anonymous information about the behaviors and preferences of PayPal shoppers on your ecommerce store. This will help you create a marketing strategy built with actionable insights (e.g., how many users shop on mobile, what items perform best, competitor insights, and actionable recommendations).

Smart Incentives: Allows merchants to directly engage with PayPal’s entire user base (that’s more than 200 million) at the start of the customer journey.

If your ecommerce store is powered by BigCommerce, you’ll be able to add the PayPal Marketing Solutions app.

Implementing Venmo on Your Ecommerce Website

It’s time to introduce a new way to pay to your customers on your online store.There are a few ways you can integrate Venmo as a payment option on your ecommerce website:

For merchants on PayPal’s Express Checkout (which includes those who are currently on Braintree), upgrade to the new PayPal Checkout.

For merchants on PayPal Standard, it’s recommended to complete a new, simpler client-side integration.

New altogether? Get the new PayPal Checkout.

Development work for the first two options can be expected to take one to two days. If you are setting up PayPal Checkout for the first time and doing a new server-side integration — expect development to take several weeks.

Several weeks of development might seem daunting, but the benefits of making the switch will make you realize that patience is a virtue.

Executive Summary

Your customers — particularly if targeting a significant millennial demographic — are using Venmo more and more frequently. And the number of merchants accepting Venmo as a form of payment is growing, too. There are a significant number of benefits to accepting Venmo on your online ecommerce store, too.

You already know how important it is to facilitate ease of payment. The easier it is for your customers to complete the checkout process, the less you’ll see abandoned carts, which will in turn increase your conversion rates. As widespread Venmo adoption continues to increase, that conversion boost could be quite significant for your business.

Because Venmo was acquired by PayPal, there are a couple of additional benefits you can expect as well. Introducing PayPal Smart Payment Buttons means your customers get instant access to PayPal Credit — giving your shoppers even more flexible payment options — and PayPal Marketing Solutions, which helps you gain even more consumer insights and opportunities to reach your target market.

Should Venmo be your next step in continuing to optimize your checkout experience? Even if you don’t currently have PayPal integrated into your ecommerce site, the time to development will be worth it!

Brett Regan is an experienced writer specializing in SaaS and ecommerce topics, with a strong focus on helping businesses navigate the digital landscape. His work covers a wide range of subjects, from ecommerce strategies to platform solutions and innovations in online retail. With years of expertise, Brett's writing provides valuable insights for businesses looking to grow and succeed in the fast-paced world of ecommerce.