Understanding the UK Value-Add Tax: How to Prepare for Brexit as an Ecommerce Business

Understanding the UK Value-Add Tax: How to Prepare for Brexit as an Ecommerce Business

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

This material does not constitute legal advice and is only for general informational purposes. Readers should consult a qualified attorney in the relevant jurisdiction to obtain advice for any particular legal matter.

The United Kingdom has a population of 66.76 million people (as of 2019) and a growing online retail market. Data from Statista shows that the online share of total retail shares in the UK grew to over 26% in 2020. In fact, according to Business Wire, the UK is the third largest online retail market and the largest in Europe.

After four years of uncertainty and confusion, a lot of back and forth and a year-long transition period, Brexit finally occurred on January 1, 2021. The United Kingdom completed its departure from the European Union and is no longer one of the EU states.

What does this mean for your ecommerce store? If you sell goods to customers in the United Kingdom (England, Scotland, Wales and Northern Ireland) from another country (including EU countries), it means quite a bit actually.

Coinciding with Brexit, on January 1, 2021, the government of the United Kingdom implemented changes to the Value-Add Tax (VAT) for goods being shipped into the UK.

If you sell goods to customers in the UK, you may have already taken the necessary steps to adhere to the new VAT rules. However, if you haven’t started, time is of the essence. Read on to learn what changes are happening, what you need to do and how BigCommerce is supporting merchants.

What Is the Value-Add Tax?

A value-add tax is a consumption tax that is added to a product at every stage in its supply chain where value is added.

For example, let’s say you sell a table. The wood is taxed when the raw materials are sold to the factory. When the factory sells the finished table to a wholesaler, it is again taxed. And when the wholesaler sells it to the end customer, it is taxed again.

VAT is usually a percentage of the total cost paid by the consumer of the product. If your store buys wood for $10 and the VAT is 10%, you would pay $11 for the wood. The seller of the wood would then keep the $10 and remit $1 to the government. If you then used the wood to build a table valued at $100, you would charge the customer $110 for the table so that you could pay the $10 VAT to the government.

The United States does not have a VAT, but many countries do have VAT with different rates, including many of the European Union countries. In the UK, the standard rate of VAT (with exceptions for certain goods) has been 20% since 2011.

What Changes Are Occurring with the UK VAT?

With the end of the Brexit transition period finally upon us, many ecommerce merchants are scrambling to make sure they can still serve customers in the UK. Here are the high-level details of the new VAT scheme that the UK government put into effect on January 1, 2021.

For goods imported into the UK in consignments not exceeding £135 in value, VAT is now charged at the point-of-sale (i.e. during checkout) instead of at the point of importation. For the purposes of this policy, a consignment is a group of goods delivered to a person, in this case your customer.

Additionally, the Low-Value Consignment Relief went away. This rule previously exempted goods valued at £15 or less.

The seller may pay the import VAT (and duties) on clearance and reclaim if they have a UK VAT number. Alternatively, the seller may opt to have their customer pay at customs. Only the owner of goods at the time of the import can reclaim the VAT.

To comply with these changes and sell your goods into the UK:

1. You will need a UK VAT Number.

Both B2B and B2C businesses selling goods to the UK will be required to register for a VAT number with Her Majesty’s Revenue and Customs (HMRC). For B2B businesses, this obligation is not required if the UK shopper provides their VAT registration number.

2. VAT will be collected on ALL low-value orders shipped to the UK.

All businesses must collect the 20% VAT at point of sale for orders less than £135 in value. The £135 threshold is based on the intrinsic value of the goods, which excludes transport, insurance or other import taxes, if separately itemized.

For orders over £135 (or consignments of multiple goods with a combined value greater than £135), VAT will still be paid at the time of import with duty.

3. Merchants must remit VAT to the UK.

All VAT collected by merchants under their registered VAT number must be remitted to the HMRC on a quarterly basis. You will submit a VAT return indicating the amount you collected during this three month accounting period.

Am I Impacted by These Changes?

Chances are you are reading this not simply because you are an aficionado of foreign tax law, but because you want answers to the all important question: does this affect my business?

If you are selling low-value (£135 or lower) orders into the UK, including through online marketplaces and B2B sales, you will indeed be responsible for collection of and remitting the VAT.

There are some exceptions for B2B merchants. If you sell goods to a UK business customer, you may not need to collect VAT if your VAT invoice includes the shopper’s VAT number and notes “reverse charge: customer to account for VAT to HMRC.”

To fully understand how these changes may apply to you, you will want to consult HMRC’s guidance or a local tax professional.

What Do I Need to Do as a Merchant?

If you determine these VAT changes do apply to you, there are several things you need to do. And you need to do them very quickly. Keep in mind that not all of these may apply to your specific situation, and we urge you to consult a tax professional for evaluating your specific needs.

Here’s your UK VAT prep checklist:

1. Register for a VAT number

Most businesses will be able to register online by visiting HMRC website. By registering for a VAT number, you’ll create a VAT online account (sometimes known as a ‘Government Gateway account’). According to the HMRC, you should receive your registration certificate within 30 business days, although it can take longer.

2. Re-evaluate your tax settings

Check your tax settings to understand if any changes are required in how you calculate and collect taxes for your UK customers. We recommend consulting with a local tax professional. For more information, check out our Knowledge Base article on Tax Settings and Avalara.

3. Update your shipping invoices

You will also want to update your invoices to include your VAT number, so you can avoid issues at customs and get your goods to your customers on time.

4. Apply for an Economic Registration and Identification (EORI) number

If you do not already have an EORI, you will need this code to identify your business in customs documents. You can apply for one here.

5. Update the ISO Country Code (for Northern Ireland Only)

This one only applies if you are selling into Northern Ireland from outside the UK. As a means to protect the Ireland/Northern Ireland Protocol, Northern Ireland will take on dual status and fall within both the UK and EU VAT guidelines. In addition to the steps above, you will also need to update the ISO country code to “XI.” For more information, visit the HMRC policy paper for Northern Ireland.

If the above are not done and you continue to ship goods to UK customers anyway, the customer receiving the shipment will have to pay to cover the VAT charges that should have been covered by the merchant in addition to the VAT charges they are already charged as a customer. (Remember VAT applies through every stage in which value is added).

Because they are effectively being charged VAT twice, this could result in customers requesting the merchant refund some of the tax they paid. And it’s generally a poor customer experience. Additionally, if the customer refuses to pay the VAT charges, then the product will be shipped back to the merchant with return shipping charges and additional fees levied on the package.

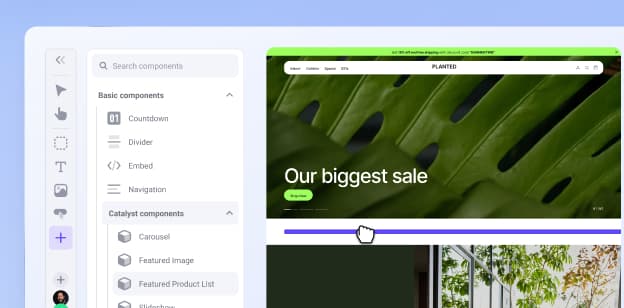

How Is BigCommerce Supporting This Change?

BigCommerce will be making the VAT invoice that was previously exclusively available for merchants in the UK, now available for merchants outside the UK who are selling to customers within the UK. This invoice will automatically be generated for these orders, with the main differences from the standard template being an extra column to show tax rates and updated labels to indicate if prices include or exclude tax.

While BigCommerce partners with multiple tax services, not all tax services will support the UK VAT changes. If you are interested in a solution that will support these changes, consider Avalara AvaTax. For more information, visit the Avalara AvaTax VAT information page or contact Avalara’s support team. Additionally, if you’re not using AvaTax currently and you decide to do so, see our article on configuring Avalara AvaTax within BigCommerce in the Help Center.

Our approach may evolve and change over time. As we continue to learn more about how these and future changes impact our ecommerce merchants, we will share what we learn.

Conclusion

Brexit may have been a long time coming, but the time to take the necessary steps to be in compliance with these changes is quickly running out. Even if you apply today, it can take 30 business days (or longer) to receive your VAT registration. Compliance with the law was expected starting on January 1, 2021.

While the ideal time to prepare for the VAT updates was several months ago, the second best time to prepare is right now. We hope this article has helped you understand the VAT changes and given you a better understanding of what you need to do.

We also recommend checking out the following resources for more information:

Changes to VAT treatment on overseas goods sold to customers from 1 Jan 2021 (HMRC)

UK and EU eCommerce VAT reforms (Avalara)

Potential Brexit-related changes to export licences and certificates (HMRC)

This material does not constitute legal advice and is only for general informational purposes. Readers should consult a qualified attorney in the relevant jurisdiction to obtain advice for any particular legal matter.

Brett Regan is an experienced writer specializing in SaaS and ecommerce topics, with a strong focus on helping businesses navigate the digital landscape. His work covers a wide range of subjects, from ecommerce strategies to platform solutions and innovations in online retail. With years of expertise, Brett's writing provides valuable insights for businesses looking to grow and succeed in the fast-paced world of ecommerce.