Cater to Your Customers’ Needs With Product Protection

Ecommerce is having its moment. In 2020, it grew to $861B according to Digital Commerce 360. Every year, ecommerce accounts for more of total retail sales, hitting 21.3% of retail sales in 2020. That’s up from 15.8% in 2019 and 14.3% in 2018.

The trend is clear. People are buying online now more than ever. With lower barriers to entry and a continual flow of new entrants, competition is stiff. Retailers are bending over backwards to capture and keep customers.

“You can’t wait for customers to come to you. You have to figure out where they are, go there and drag them back to your store.”- Paul Graham, Y COMBINATOR

Every retailer is vying for consumers’ attention and spending power. With an ever evolving industry, the rules of the game have been altered. New channels emerge while others become insignificant. Hubspot says 71% of customers don’t trust sponsored ads on social networks anymore. So, if you’re not doing something new, you might be wasting your money.

The challenges don’t stop post acquisition. Once consumers walk through your “digital door,” getting them to buy something is a feat in and of itself. Online stores contain flexible UIs, detailed reviews, dynamic prices and customized offers. Even with these levers, only ~2.75% of customers complete a purchase on average.

Once you finish that rat race, it’s onto the next: driving repeat purchases. According to Clever Tap, the week 12 retention rate is 7.1% for existing users and a low 1.4% for new users. Single digit conversion rates across the board. That’s why companies are fighting tooth and nail for incremental lifts.

Merchants must provide customer-centric platforms that are differentiated, drive purchases, and improve customer lifetime value (CLV). Now, more than ever, ecommerce businesses must innovate and adapt or become irrelevant.

“Ecommerce leaders will have to keep with these changes (and others) to survive and stay ahead.”- Linda Bustos, Ecommerce Expert from Get Elastic

Get Ahead With Value-Added Services

As an example, Amazon, Walmart, Best Buy, and the big retailers, offer their customers lots of options and value-added services, such as payment plans, shipping insurance and product protection. Historically, these services could be hard to provide, so only large retailers could offer them.

Now, companies including Affirm, Route and Extend unlock value-add services for every retailer and their end customers. These technology-first platforms offer white-glove services out of the box. They have democratized payment options (BNPL, financing, etc), shipping insurance and product protection plans.

In particular, product protection plans can help build customer loyalty and increase a consumer’s intent to buy. For instance, Assurant found that extended warranties, on average, increase a consumer’s intent to buy by about 25%. Additionally, according to After, a positive claims experience can translate to higher lifetime value and higher propensity to purchase additional products and services.

What is Product Protection?

Products can be covered in a variety of ways. Many products have included manufacturer warranties that cover defects in workmanship for 6 months to a year typically, but product protection plans go above and beyond.

Product protection, also known as service contracts, guarantee a product’s working condition for an extended period of time. Product protection can come in many different forms:

1. Extended warranties.

These service contacts extend the duration of manufacturer warranty coverage. They start when the manufacturer warranty expires and then extend the coverage of mechanical or electrical malfunctions for a specified time.

2. Protection plans.

These service contacts protect products from specified damages or accidents. Each protection plan has different terms. A common plan is the accidental damage from handling (ADH), which covers damage caused by accidents like drops, breaks and spills.

With product protection, merchants can provide customers with more comprehensive coverage that can alleviate a customer’s fears at checkout. It’s important to note that plans are not mutually exclusive.

A great example is an iPhone; it can be protected in several ways. If your iPhone battery fails from a defect in manufacturing within the one year of purchase, that is covered by the manufacturer warranty.

But that warranty doesn’t cover accidental damage. So if you’re prone to dropping your phone, you might buy AppleCare, Apple’s protection plan. AppleCare offers accident coverage so you’re not paying out of pocket if you drop your phone and crack your screen.

Why Does Product Protection Matter?

Customers want product protection. This is evident by the $120.79 billion global extended warranty market size in 2019. This market is projected to reach $169.82 billion by 2027 according to Allied Market Research. There is clear market demand. That makes it a crucial element of your ecommerce experience.

Plus, offering a warranty can also help grow sales, according to Assurant’s Connected Decade survey. For video game consoles and set-top streaming boxes, including an extended warranty increases the likelihood of purchase by 22%. That likelihood increases by 21% for smart TVs and DVRs.

The value of product protection is obvious. The trend is clear. Consumers value extended coverage, which also unlocks new revenue streams and value for businesses.

1. Products are protected.

Extended warranty coverage gives consumers peace of mind. Additional coverage ensures customers will always have products they love that are working. Coverage can be personalized to customers’ needs for a given product, like animal biohazard coverage for appliances.

2. Quickly resolve issues.

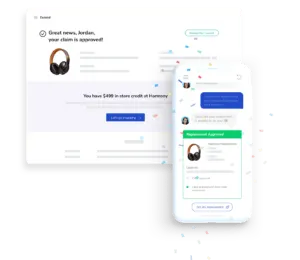

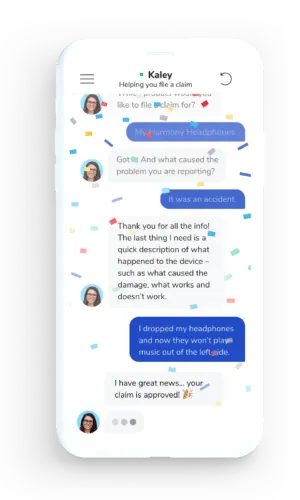

Product protection improves the customer experience by turning a potentially negative product experience into a positive one. For example, with Extend, customers can chat with a virtual claims assistant 24/7 to provide a fast response and get replacement products out the door quickly — turning an unhappy customer into a delighted one. This high-quality service can facilitate stronger ties between customers and retailers.

3. Retailers can drive profits.

Product protection expands businesses by driving net profit, increasing conversion, and improving customer experience.

For example, SoClean partnered with Extend to enhance it’s strong reputation for providing great customer support. They wanted to ensure that, should something go wrong with their devices, their customers would have an easy path to navigate to getting things resolved. With Extend, SoClean was able to test their warranty offering. One experiment drove a 167% increase in revenue.

4. Increase purchase conversion rate.

Consumer confidence to purchase goes up when they see someone stands behind the product they are considering purchasing. Intuitively, it makes sense, customers like the extra validation.

In fact, product protection actually increases purchase conversion. For BlendJet, overall product purchase conversion rates increased 11% when the company started offering Extend product protection plans.

5. Improve customer experiences.

Great product protection improves customer loyalty by turning a negative experience into a positive one. In today’s environment, retailers need to give customers options. Ecommerce first saw this explosion with payments (BNPL, financing, etc) and now it’s seeing the rise of product protection.

Product protection also gives merchants a channel to bring customers back. For instance, when a claim is fulfilled at Extend, it drives customers back to the merchant site to get a replacement. Customers can purchase a replacement product, which will count as a net new sale for the merchant.

This multi-touch engagement strategy adds another meaningful touchpoint to the customer journey. Positive customer engagements, and turning potentially negative experiences into a positive, can lead to stronger customer loyalty.

Different Types of Product Protection

Product protection has been around for a century. Back in 1919 AIG was the first company to offer these plans to merchants. Until recently, product protection suffered from archaic claims processes and a distribution problem.

On top of that, claims processes could take months to resolve and often resulted in frustrated customers. New easy to use technology, like Extend, increases access to product protection, so any merchant, regardless of their size, location, or product catalog, can offer product protection.

Product Protection can also come in many forms:

Replace – these service contracts work well with everyday items that may be relatively low in price. Think Skullcandy earbuds, it’s easier to replace a damaged earbud rather than trying to repair it.

Repair – these service contracts are for items whose value is greater than the cost of labor. It makes more sense to repair a Peloton bike rather than replace it.

Plan Duration – these service contracts simply extend the manufacturer warranty so consumers are covered beyond the manufacturer’s warranty period.

Simple Product Protection – these service contracts allow for a little more customization. They often extend the duration of manufacturer warranty and may even expand coverage options. These plans kick in after the manufacturer’s warranty expires.

Accidental Damage from Handling (ADH) Product Protection – these service contracts protect against more damage, like drops and spills, than a manufacturer warranty. Since they cover a different set of issues, these plans begin at time of purchase.

With so many options, merchants have the power to pick the coverage that not only fits their product but also fits their customers.

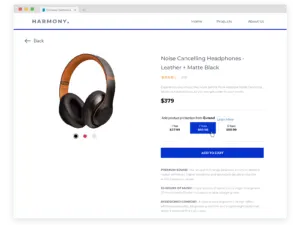

Uplevel Your BigCommerce Store with Extend

When it comes to retail, the future is written online. Online sellers face an increasingly crowded, fast-evolving field. Their success will require the ability to customize their offerings to best serve their customers. Retailers will need the resources to meet customers needs and open new revenue streams. Product protection plans empower retailers to differentiate themselves from competition, drive purchases, and improve customer lifetime value.

BigCommerce’s flexible, open SaaS platform makes offering product protection a snap. BigCommerce offers a simple pre-built integration to Extend’s API solution. This collaboration means every merchant can uplevel their online offerings and benefit from a protection plan program in no time.

Rohan Shah is the Co-Founder and Head of BD & Partnerships at Extend. Formerly led product at Boston Consulting Group's Digital Ventures practice and prior to that was founder & CEO of a venture-backed company Within.