Amazon Advertising & PPC: What You Need to Know, How to Get Started and a Tool to Help You Along the Way

Amazon Advertising & PPC: What You Need to Know, How to Get Started and a Tool to Help You Along the Way

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

If I asked you to name the biggest Amazon story of the last year, what would you say?

Perhaps you’d answer with “Alexa, Echo, AI, and in-home assistants.”

Or maybe you’d say “The acquisition of Whole Foods and the move into grocery delivery.”

Or maybe “HQ2 and cities vying for Amazon’s arrival.”

Or “Amazon’s big private-label push, especially with Amazon Basics and apparel.”

Good cases can be made for why any of those Amazon endeavors (and others) might be contenders for the biggest Amazon story of the last year.

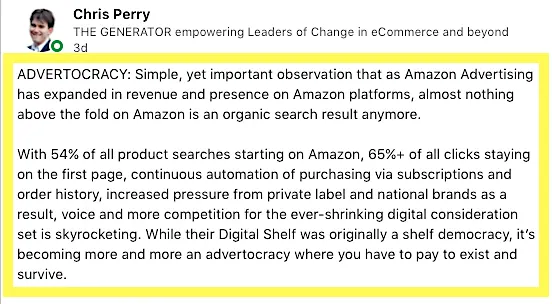

But for me, as someone who’s done Amazon-related work for a decade and who writes about Amazon as my job, I’d argue that the biggest Amazon story of the last year is the rise of Amazon Advertising.

In fact, I’d argue that it’s an even-bigger, more-important story because of what it isn’t — namely a consumer-facing retail product or a service such as Prime.

But if you didn’t see this coming, you’re not alone.

What Amazon Advertising actually is turns out to be far more sophisticated than many thought. It is essentially a double sale.

Here is what I mean:

The first part of the sale is the PPC element, the part where Amazon merchants bid on keywords that can win them premium position of their products (a banner on the top of search results, called out in a box in the sidebar, placed amongst high-ranking products in search results, etc.). This makes Amazon money.

The second is when shoppers buy the displayed products because what they were seeking appeared in that key spot and got their impression, click, and conversion into a sale. Those sales take place on Amazon, and make Amazon money.

So, Amazon Advertising is a double sale (as explained above) and a triple win for Amazon that goes like this:

The buyer finds the product that is theoretically the best match.

The seller with the best-matching product sells more and moves up in rankings.

Amazon captures the ad fees and a part of the sale.

Needless to say, if you are an Amazon shopper – and really, who isn’t now? – you’ve likely bought one of these promoted products.

Amazon does an incredibly good job making the products appear like organic search results while also calling them out as “Sponsored.”

And if you are an Amazon merchant, you’ve likely dabbled with Amazon Advertising in Seller Central or Vendor Central.

For merchants, the question now is not: “Are you using Amazon Advertising?” That ship has sailed.

Now it’s a question of: “How good are you at using Amazon Advertising?”

If you’re merely average, you’re going to get beaten by competitors who:

Find keyword opportunities.

Bid smarter.

Manage their budgets better.

And/or who outsource their Amazon Advertising to experts.

It’s not enough to run ads on Amazon, merchants have to work those ads so that the ads work well for them.

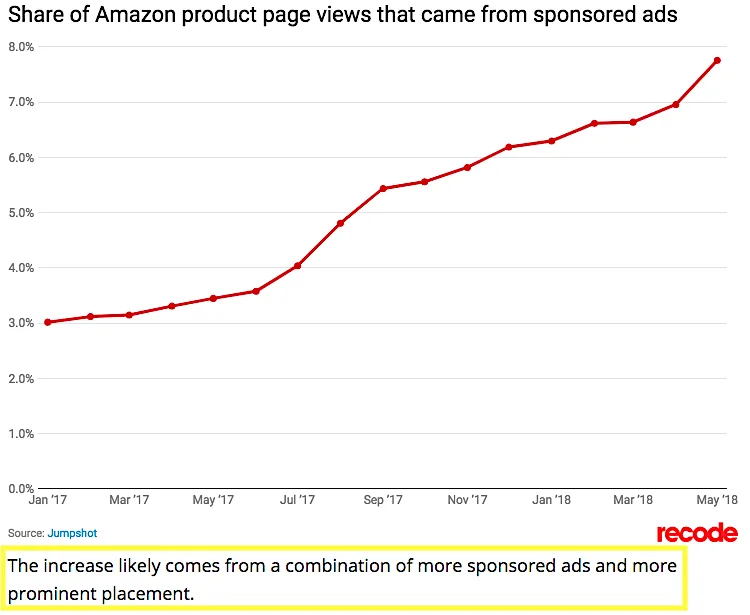

And like any advertising marketplace, as popularity increases, so does price and competition.

Here’s where we stand as of December 2018 with Amazon Advertising:

Amazon consolidated all of its advertising offerings into one umbrella program at Advertising.Amazon.com, making the options available to 1P vendors and 3P sellers more plentiful and accessible (and thus more competitive) than ever before. In short, many sellers and vendors are already participating in advertising, with more jumping in every day.

Sponsored Products Ads are available to all sellers on both Seller Central and Vendor Central and have become the PPC go-to for Amazon advertisers.

Sponsored Brands Ads (formerly Headline Search Ads) are rising in popularity as they are now available to all brand-registered sellers and they offer placement opportunities differing from Sponsored Products Ads as well as a link to a brand’s Amazon Store.

Product Display Ads have gained traction given that they appear on competitors’ product detail pages.

And of course, bid values get more expensive as more sellers partake in ads.

How do you stay competitive at Amazon Advertising?

The answer is by being like Amazon itself: Not relying on the status quo.

Here’s how:

Find keyword opportunities that aren’t already played out in terms of usage and bid escalation. If everyone is bidding on the same keywords, no one wins save for Amazon who collects the ever-increasing auction price. Look for not-necessarily top-ten or high-price keywords but those which show up enough and convert well for you and your competitors. Where can you find these? In the User Search Term Report (literally a list of words that shoppers are using to find products) and via reverse ASIN look-up where you’ll find keywords associated with any ASIN and how they rank. You’ll quickly train yourself to recognize opportunities others have missed.

Don’t be afraid to spend money to make money. If a keyword is a true winner, it’s probably worth those extra cents on the bid. Don’t lose it over pennies. And feel free to use Bid+ if you really want to be covered in the event a bidding war heats up. Also remember that while you want to keep your ACoS manageable, the lowest ACoS isn’t always desirable. You’re looking for the sweet spot for ROI so don’t cheap out.

Don’t just rely on Sponsored Products Ads (if you can help it).

If you’re a 3P brand-registered seller on Seller Central or you’re a vendor on Vendor Central, you have access to Sponsored Brands Ads (the new version of Headline Search Ads), which means there’s less competition than there is with Sponsored Products Ads. SBA placement is great for both sales and branding as it can take shoppers to your whole Amazon Store or brand page.

As Product Display Ads aren’t available within Seller Central (even to brand owners), there is even less competition there as they are entirely for 1P vendors.

Mix it up and see what works. Just like with stocks, think diversification.

Experiment and let the data dictate which kinds of ads are best for your products.

Run automatic SPA campaigns as well as manual ones. Again, strength in diversity. Sure, with manual campaigns you have more control over Ad Groups and negative keywords, but don’t dismiss auto campaigns as useless. Run them and let the Amazon algorithm work its magic. As well, check your auto campaigns and I guarantee that you’ll find that they’ve pulled in keywords that you hadn’t considered before (not to mention competitors’ ASINs where you can view their product listings and find even more keywords).

Go beyond the tools available in Seller Central and Vendor Central. Both of these hubs are essential, but they’re jam-packed and they serve hundreds of purposes and they offer no competitive edge. If you’re serious about Amazon Advertising, try an application or platform that is strictly for Amazon Advertising.

That’s why we made Ignite (including Ignite Plus for ad agencies and PPC consultants, as well as Ignite Managed Services for sellers who’d prefer to turn their Amazon Advertising over to our PPC experts). The amazing thing about Ignite is that when it comes to everything discussed above, Ignite helps with all (and so much more such as providing data-driven keyword and bid suggestions). And it does it all from within one scalable, easy-to-use platform. That means that you get the advantages you need for effective Amazon Advertising and you save time by doing it all from one app.

Finally, and most importantly: stay curious and hungry.

Look for opportunities, however small, and leverage those to differentiate your ad campaigns from those of your competitors.

The differences add up quickly and they are the very stuff that will help you win more top spots that lead to sales (not to mention brand awareness and organic ranking and sales).

Never stop learning about advertising and never stop testing and optimizing. Read about Amazon PPC, attend webinars, and stay involved in your campaigns.

Amazon Advertising is a living organism, which means that it changes. What worked yesterday won’t work tomorrow, so you need to keep up with education and campaign adjustments.

This is not a set-it-and-forget-it sort of thing, at least not if you want to drive revenue and build a brand.

Treat Amazon Advertising like you treat your product listings and never ever stop optimizing and looking for opportunities.

Wherever you are in your Amazon Advertising journey, I hope that this chapter provides you with:

A solid understanding of the many moving parts that make up Amazon PPC

Clarity and knowledge that informs, educates, and empowers you to level up as a seller

Practical tips and techniques that give you the edge over your competition

Let’s get started.

Welcome to Amazon Sponsored Products… Now What?

Amazon states that:

“Sponsored Products and Sponsored Brands allow advertisers to promote their products or brand to make it even easier for customers to discover and purchase products on Amazon.”

That tells us what they allow and what the do, but what exactly are they?

The question is really twofold:

What is Amazon Sponsored Ads? Broadly speaking, Amazon Sponsored Ads is the Pay Per Click (PPC)/Cost Per Click (CPC) division of Amazon Advertising (Advertising.Amazon.com). Amazon currently has six divisions within its advertising umbrella. Sponsored Ads is the most accessible and available, and thus, the most widely used.

What are Amazon Sponsored Ads? More specifically, these are ads that occupy premium auction-won positions wherein a product or brand is advertised in spot deemed preferable to organic search results (while also being included in the organic results).

Thus, when we talk about Amazon Sponsored Ads, we are talking about an advertising offering wherein products are displayed prominently because the merchant has won premium position by outbidding competitors vying for the same keywords.

And every time a potential buyer clicks on that sponsored ad, the seller pays for the click (hence, PPC).

What kinds of ads are available and to whom?

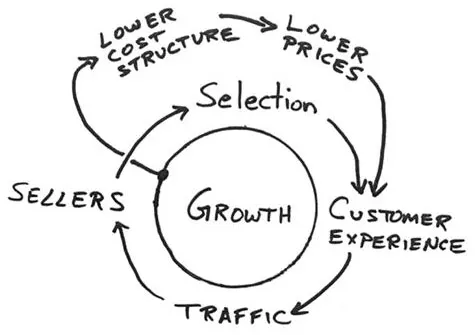

In keeping with what is know as “Amazon’s Virtuous Cycle,” the more a merchant does for Amazon and customers, the more the merchant is rewarded with options and opportunities, and in turn, the better able the merchant is to sell more, which benefits both the merchant and Amazon.

And of course, the more money that Amazon makes from a brand or a product, the better the product does in relevance and ranking, which perpetuates the winning cycle. Selection increases prices drop, customers also win.

And customers winning is Amazon winning.

Amazon’s Virtuous Cycle (AKA The Bezos Napkin Sketch)

In terms of advertising, this means that Amazon offers the most (and best) offerings to 1P vendors with whom Amazon has a direct supply relationship and can negotiate large-volume orders.

These 1P vendors may use the full suite of Amazon Sponsored Ads, which includes:

Sponsored Products Ads.

Sponsored Brands Ads (formerly known as Headline Search Ads).

Product Display Ads.

3P sellers who own their brands and have registered those brands with Amazon’s Brand Registry may partake in Sponsored Products Ads and Sponsored Brands Ads.

Being able to utilize SBAs is one of the many perks of being Amazon brand registered. Another big perk is brand protection in the fight against counterfeiters and other usurpers.

Because 3P sellers who resell products or otherwise do not own their brands or have them registered with Amazon are less connected with Amazon’s direct interests (and often compete with Amazon), they are limited to Sponsored Products Ads.

However, Sponsored Products Ads are still a powerful vehicle for driving sales, overtaking competitors, and expanding. And that, along with their availability to the largest number of sellers, is why we will focus most on them.

Amazon PPC Advertising: Who Gets to Use Which Tools

[ultimatetables 59 /]

Sponsored Products Ads: A Must-Do For All Sellers

What can sponsored products ads do for you? Quite a bit.

1. Sponsored Products Ads Introduce Your New Products to the Marketplace.

They give visibility for your product launch so you can start selling and earning.

With that in motion, you can start accumulating reviews (grab a free trial of Seller Labs’ Feedback Genius to maximize reviews)

2. Sponsored Products Ads Boost Your Product Sales and Rankings Through the Halo Effect.

As you sell items through the Sponsored Products Program, your sales and your rankings will improve. These improvements will help your organic search position and you’ll capitalize on those.

That’s the halo effect; as you advertise and make sales using Sponsored Products ads, that tends to drive organic sales as well.

3. There’s Nothing Like Sponsored Products Ads to Attract and Acquire New Customers.

Sponsored Products ads are an amazing tool for acquiring new customers who then make repeat purchases and become loyal to your brand (especially in the consumables marketplace).

4. Sponsored Products Ads Just Help You Sell More.

If none of the above applies to you, you can just use Sponsored Products ads to get sales. Any time that you can pay one dollar to make two dollars is a great exchange.

I need to stress that all of the above are not simply nice extras or benefits, they’re necessities in today’s ultra-competitive sales environment.

It’s not enough to run Amazon Sponsored Ads, you have to do it better and smarter than the competition if you are to succeed.

And that is going to take some education, some practice, and going beyond Amazon’s Campaign Management tool in Seller Central in Vendor Central.

Let’s Start with Some Basic Amazonomics Truths

Are Your Running Amazon Sponsored Ads?

IF YOU’RE NOT CURRENTLY RUNNING SPONSORED PRODUCT ADS:

You’re gifting your competitors with an enormous advantage.

Simply put, their products are getting better placement and more impressions than yours are.

Sure, you’re saving a little money while the competition spends it, but they’re getting the sales, the page-one placement, the reviews, and the rankings.

IF YOU ARE CURRENTLY USING SPONSORED PRODUCT ADS:

You may be reaping some rewards but you’re probably spending too much time working with frustrating Amazon reports and Excel pivot tables.

And you’re likely spending too much money trying to outbid your competitors.

Ask yourself who wins in a scenario where you and your competition are all using the same Amazon-provided data.

Without any seller having a proven advantage, the real winner is Amazon as the entire field is continually upping bids and paying Amazon more in ad fees only to jockey for an unattainable edge.

Important to Know

What is an Impression on Amazon?

An impression is counted when Amazon shows a shopper your product ad (on either a search results page or on a product detail page).

Placement depends on relevance and bid—you’re not charged for impressions, only clicks.

Why Sponsored Products Ads Work

Amazon has banked big on the Sponsored Products Program and it shows in how the company has parceled out the on-screen real estate to give Sponsored Products Ads prime placement within the Amazon app, on the mobile browser side, and in the native-site desktop/laptop environment.

In addition to running in the most-choice locations, the ads are almost anti-ads in that they work not by standing out as we expect of ads, but instead, by blending in and looking like organic search results with placements that suggest that they are some of the best matches.

This way in which Amazon has steered and tiered search results is well considered and sellers must embrace that this is about being first on search-results display as much as it is about being first to market.

Important to Know

Incentivized reviews (banned in October 2016 but still used by “feedback farms” who often recruit on social media) served many purposes, not least of which was vouching for a product and giving it credibility.

Five stars and a glowing review communicated to potential buyers “Yes, out of a field of hundreds of options of this type, this one is legitimate and the one you want and can trust.”

Sponsored Products Ads, while not a like-for-like replacement for incentivized reviews, communicate a similar message—not with written testimonials but by first-view placements and placements amongst and alongside organic best matches.

The old ad display strategy of “marked in bold and above the fold” is no longer good enough.

The landscape for displaying ads has changed significantly, especially given rendering for mobile devices.

In order to sell, you’ve got to be seen but simultaneously- not seen as an obnoxious ad.

You need your products at the top of the list of search results, well integrated into organic listings, in sidebars, and on competitors’ detail pages.

This visibility and integration is what Amazon Sponsored Products is all about.

You may have the best product in the world, one that matches everything for which a shopper is searching, but none of that means anything if the product detail page languishes toward the bottom of the listings, or worse yet, not on the first page.

Sponsored Product Ads Campaigns

Before we dive into setting up campaigns and running them, we need to define the parts that make up the whole and we need to understand how those parts interact and how their success is measured.

It’s important to understand a campaign structurally and organizationally and to be on the same page regarding terminology, jargon, and the oh-so-many acronyms.

What is an Amazon Sponsored Product Ads campaign?

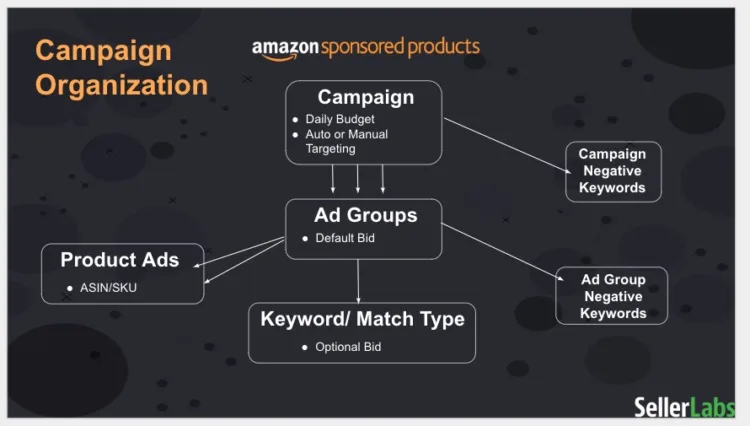

The highest-level grouping within Amazon Sponsored Products ads organization. A campaign should be thought of as a container, a vessel holding one or more Ad Groups and their contents.

We recommend one product per campaign just to keep things clean and clear. It’s easy to link that product to the campaign advertising it: simply connect via ASIN/SKU.

Within any single campaign, you’ll select or set the following:

CAMPAIGN NAME: Make it easy on yourself and pick a campaign name that is simple and descriptive and easy to remember.

TARGET ACoS: Average Cost of Sale (ACoS) is a metric that Amazon created to indicate the cost-effectiveness of your advertising campaign. It is the amount spent on advertising divided by the revenue attributed to the advertising. A lower percentage is better. If you don’t know where to start, we suggest 25%.

TARGETING TYPE (Automatic or Manual)

Automatic: Amazon’s algorithm picks keywords based on your listing content and competitor products. Although not required, we suggest having a low-budget auto-target campaign in place as it will help you discover new keyword opportunities.

Manual: You control the keywords based on what you know and what Ignite suggests via a database comprised of tens of millions of keywords and user search terms. You will want to create broad-, phrase- and exact-match targeting ads to attract shoppers using specific search terms to gain the edge on the competition.

DAILY BUDGET: What you’re willing to spend on advertising a campaign during a 24-hour period.

For an auto-target campaign, we suggest a starting daily budget of at least $5.00–$10.00.

For a manual-target campaign, we suggest $20.00 per day to start.

AD GROUPS: Think of these as smaller containers within the larger campaign container. Within any single ad group, you’ll select or set the following:

Keywords and Match Types

Default Bids

Negative Keywords (You can also set these up on the larger campaign level.)

What are Amazon Sponsored Product Ad keywords?

These reside within an ad group and they are the words that you tell Amazon are related to your product.

You base them on the words/phrases for which you think people search (user search terms).

When we talk about a keyword in the context of Sponsored Products, we’ll also be referring to its match type, which affects how the keyword is picked up in a user’s search.

Keywords become more nuanced as you dive deeper into Sponsored Products. A top-level keyword will have several user search terms rolled into it.

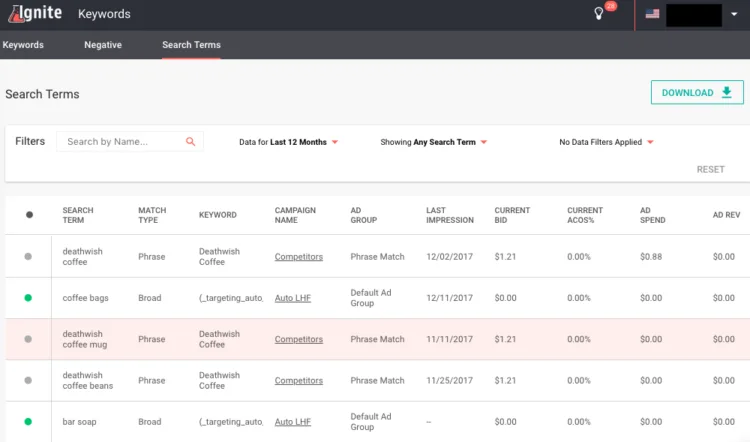

What are Amazon Sponsored Product Ad user search terms?

Words/phrases that shoppers input into Amazon searches.

Amazon then matches up user search terms with keywords in order to display the most relevant products.

This is where the different match types (broad, phrase, exact) connect with different versions of keywords.

Here’s an example user search term report found in the Ignite Advertising Platform.

What are the Amazon Sponsored Product keyword match types?

1. Auto-Target Match Pros and Cons.

Only used within Auto-Target campaigns. Amazon’s Algorithm picks keywords based on your listing content and competitor product listings.

Pros:

Quick-and-easy method.

Amazon generates these keywords based on its data collection, which, needless to say, is pretty vast.

You’ll get some keywords you wouldn’t have thought of.

Cons:

You sacrifice control for ease.

You’ll get some duds in the mix and those will cost you.

Amazon has no incentive to scrutinize or minimize these because Amazon earns when a keyword garners a click.

Auto-Target Example Product: Apple Slicer

Some of the keywords suggested by the Amazon auto-target campaign include the following, a list that seems a little disconnected and even bizarre at times:

b0199sxmte

vitamin blade

potato peeler

potato cutter

apple corer

apple peeler

fruit peeler

pampered chef chopper

fruit cutter

peeler with grip

pie carrier

potato chopper

b01mqdal0a

gourmet chef

B00ezqqo8m

get rid of love handles

mandoline slicer

pampered chef

But remember that Amazon is no slouch when it comes to collecting data and knowing its customers.

That said, these keywords are indeed, in some way, connected to the apple slicer product connected via ASIN/SKU.

It’s just a matter of how closely connected and if one thinks that pursuing that connection in the form of advertising is worth the time and money.

Important to Know

What are considered conversions?

Conversions (Orders) are counted when a shopper purchases your product as a result of clicking on the Sponsored Products ad.

Even if that shopper purchases a quantity of 15 units of the product, it still counts as a single conversion because an order is counted per transaction rather than per unit. Amazon displays your ad -> shopper sees it (an impression) -> shopper clicks ad (a click) -> shopper buys product -> the ad has been converted to a transaction/ order.

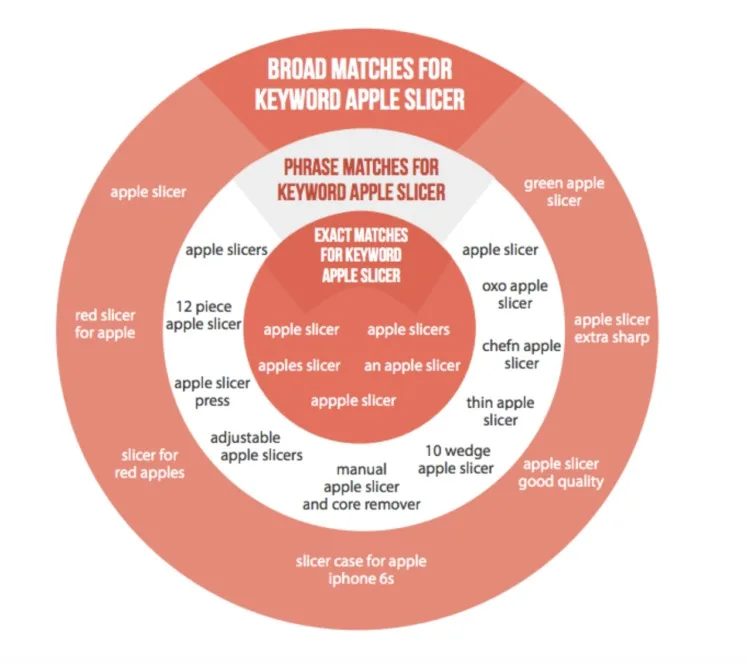

2. Manual-Target Matches: Think of these as a literal bullseye target.

Broad Match: Must include specified keywords but they can be in any order and it allows for other words before, after, and in between. This sort of match is the outside ring of the bullseye, the widest and most spacious and easiest to hit but not the most accurate or rewarding. Matching these keywords with a shopper’s user search terms could result in a good match that results in a sale but it could also result in a not-so-good match and the user going elsewhere for a better fit.

Phrase Match: Consists of specified words that must be together in sequence (allows for slight misspellings, plurals, and other words before or after). This sort of match is the middle ring of the bullseye, which is to say, you’re narrowing the field and getting more accurate at matching your keywords with user searches. This is more valuable match than a Broad Match because the likelihood of your product being what the shopper wants is higher, and thus, the likelihood of a conversion is increased.

Exact Match: The exact word/ phrase just as the user searched for it (allows for plurals, misspellings, prepositions). Bullseye, your aim is true! An Exact Match is the best type of match and the most valuable because it means that you hit the specifics of the small center ring and nailed what the user was looking for exactly. You and the shopper are in sync and this is likely to result in a conversion from ad to order.

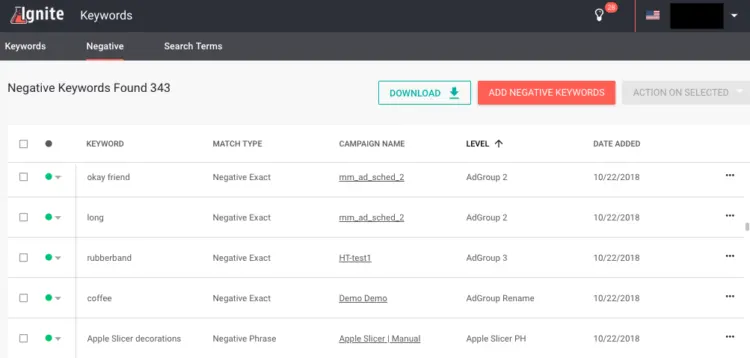

Negative Keywords: These work like a blacklist. They are words that you expressly do not want to bid on. They are managed at the campaign level and more specifically at the ad-group level.

Why would a seller need or want to use both auto-target and manual-target campaigns?

There is no doubt that if you really want to make the most of Sponsored Products ads, well-managed manual-target campaigns are the way to go.

You get more data and more control over that data, which in turn, allows you to fine tune your campaign and optimize for higher conversions and lower ACoS.

That said, auto-target campaigns are not without their merits—when used in conjunction with manual-target campaigns.

Auto-target campaigns are a great way to easily and cheaply collect data without being heavily involved in order to do so.

If you run a low-budget auto-target campaign as a complement to a manual-target campaign for the same product, you will pick up some interesting keywords and user search terms and you will be able to work those into your manual-target campaigns and to do so to your advantage.

OK, but why a higher daily budget for the manual-target campaigns?

Think of manual-target campaigns as vacuuming up the most and the best keywords, user search terms, stats, and data.

Now think about the little crumbs and things that got missed during first pass, stuff you can’t even see sometimes. Auto-Target campaigns sweep those up for you.

Which is more valuable in terms of what it collects—the vacuum (manual-target campaigns) or the broom (auto-target campaigns)? The vacuum.

So manual-target campaigns are where you want to put the bulk of your budget.

Why no daily budget but default bid for manual-target campaigns?

Because while you need to set a daily cap on spending, you’re going to set your default bids at the more specific ad group and keyword levels so you can really prioritize your winners.

How Amazon Sponsored Product Ads Work

A CAMPAIGN is the highest-level grouping within Amazon Sponsored Product Ads organization/ management. A campaign should be thought of as a container, a vessel holding one or more Ad Groups. Settings at Campaign Level:

Daily Budget

Targeting Type (Auto or Manual)

Campaign-Level Negative Keywords

AD GROUPS are components that comprise a campaign. They can be thought of as smaller containers within the larger campaign container. Settings at Ad Group Level:

Keywords and Match Types

Default Bids

Ad-Group-Level Negative Keywords

Links to Product Ads (Connect via ASIN/ SKU)

KEYWORDS are the words that you tell Amazon are related to your product. You base them on the words/ phrases for which you think people search. You can stick with your Default Bid for the Ad Group or you can bid different amounts on specific keywords. Keyword Match Types:

Negative: Like a blacklist, words you express do not want to bid on.

Auto-Campaign Amazon-Suggested Target Match: This is a separate campaign wherein Amazon’s algorithm picks based on your listing content, competitor products, maybe image recognition

Manual Campaign Keyword Targets

Broad Match: Must include specified keywords but in any order. May includes other words before, after, in between.

Phrase Match: Specified words must be together. Allows for slight misspellings, plurals, other words before or after.

Exact Match: The exact word or phrase (allows for plurals, misspellings, prepositions).

RELATED PRODUCT ADS are the corresponding product listings (title and image and basic details connect via AKIN/SKU) for the items you are trying to sell through this campaign.

Understanding PPC Value: Bids, Bidding and Bid+

The Amazon Sponsored Products Program is Pay-Per-Click Advertising (PPC), which means that you are charged for a click regardless of whether or not the shopper purchases a quantity of one, a quantity of 15, or none at all.

What you’re really doing in PPC advertising is not buying clicks but trying to outbid your competitors for the ad placement and visibility that will lead to a click and then convert into a transaction.

Bids: The Straightforward Story

A bid is a seemingly simple thing but its effects are many and powerful. In PPC, a bid is defined as the maximum dollar amount you are willing to spend per ad click.

It’s not necessarily what you will pay, it’s the most you are willing to pay.

You set this number at the ad-group level or you can get more granular and set specific bid amounts for individual keywords within the ad group.

GET STARTED WITH BIDS, THEN GET BIDDING BETTER

Amazon will get you started with a suggested bid (the dollar amount they recommend you bid, based on the number of competitors and their bids for a keyword, in order to win the ad auction). This is helpful as it gives you a sense of the larger field and going rates. However, that’s not enough to stay ahead of the competition (remember that they are getting the same suggestions from Amazon based on the same data). If you want to lead rather than just keep up, turn to Ignite for advice. With keyword suggestions and recommended bids based on the historical and real-time information, it’s collecting and analyzing, Ignite can guide you and help you bid smarter and win more ads.

Example: Your bid on the Exact Match Keyword of “Apple Slicer with Safety Shield” is $1.00. You are willing to pay up to $1.00 to win Sponsored Products placement when a user enters that search term. Of all of your competitors selling similar products, many have bid on that same keyword but the highest of those bids is $0.75. All things being equal, you will win that bid and you will pay $0.76 per click (a penny above the second-highest bid). By willing to go $0.25 higher than your competition for that keyword, you only have to pay a penny more than he or she was willing to pay in order to win.

Bids: More Variables in the Mix

Historically, all things were indeed considered equal and a bid just needed to be higher than all others in order to be shown.

But with Sponsored Products ads, the highest bid doesn’t always win. Why not?

Because Amazon is trying to sell a product (any ad revenue is extra) as quickly as possible and with the greatest customer satisfaction and the fewest product returns.

In order to do that, Amazon matches the best ad copy with the right keywords in order to put the right product in front of the right shopper.

Amazon determines the quality and relevance of an ad. Here are some things that we know about how Amazon determines ad quality and relevance with regard to Sponsored Products.

Amazon removes ads that aren’t Buy Box eligible.

The remaining ads are analyzed for relevance (category is crucial—if a product isn’t listed in the correct category, the ad and product will not be relevant) and ranked in an order that takes into account the bid value and the probability of the ad getting clicked (Click-Through Rate is a determiner of this). Ad Rank Position = Bid x CTR.

Amazon Bid+

When enabled within a manual-target campaign, Amazon Bid+ will automatically boost ad group or keyword bids up to 50%.

And because a seller has paid a premium on top of the bid, Amazon will display ads won with Bid+ in the top row of the search results page.

So if you’re using Bid+, you’re telling Amazon that you want that top spot and you’re willing to pay for it.

Be aware that your average Cost Per Click (CPC) will increase by using Bid+ but your daily budget constraint won’t increase as that is fixed until you change it.

COST PER CLICK (CPC): The sum of your Spend (dollars) divided by the sum of your Clicks (number) expressed in a dollar amount. This gives you a sense of, on average, how much you have to spend to get a click. This is lower than your bid amount because your bid is the upper limit you are willing to pay per click. CPC is helpful in determining how much you’re paying to win clicks as well as understanding your ROI. A higher CPC indicates that a keyword is in demand and the competition is bidding on it as well.

CLICK-THROUGH RATE (CTR): The number of clicks that your ad receives divided by the number of times your ad is shown (impressions) shown as a percentage. CTR % = Clicks ÷ Impressions (e.g., if you have 1,000 impressions and 10 clicks, your CTR is 1%). A “good” CTR depends on category and product, but generally, 0.5% (one half of one percent) is considered “decent” and highly-targeted brand-specific terms might have a CTR of around 5%. Most click-through rates are below 3%. Extremely targeted terms receive higher click-through rates, usually around 5%. Most broad match targeted keywords have a CTR below 1%.

One More Thing to Keep in Mind

Because Amazon is so customer focused, product price and reviews are also of importance in placement.

A low-priced product with five-star reviews can win a premium placement with a lower bid because Amazon deems this product more desirable (and likely to be clicked and purchased) than one with a slightly higher price and slightly lower ratings.

By the same token, that product that Amazon has deemed less desirable will have to come in with a higher bid if it is to win for that ad.

Putting Theory Into Practice: Time to Go Live

At this point, you understand Sponsored Products campaign components, structure, and organization.

Keywords match types and user search terms have been covered.

And you’ve gotten a taste of how Amazon operates their PPC program and how bidding works.

We’re now at the juncture where experts get into their personal takes on PPC theory and strategy (often in the form of paid publications or seminars).

There’s value there, but that’s not how we think that your time and money and efforts are best spent.

We built Ignite so that Amazon sellers could spend more time innovating products, bringing them to market, selling their wares, growing their businesses, and building their brands; and less time learning about the new, hot PPC strategies of the moment and working with frustrating tools and complicated reports in Seller Central.

So, let’s look at how to put all of this in to practice.

Combine What You Know With Where You Want to Go

Running a successful Sponsored Products Ads campaign is the result of knowing what you want to achieve and mastering the resources that make that possible.

Clarify Your Aims and Set Your Goals

Are you looking to try Sponsored Products Ads for the first time because you know that your competition is using them?

Are you on the precipice of launching a new product?

Trying to increase your conversion rate on an existing product?

Looking to bring your ACoS below a certain amount?

Trying to reduce time and frustration spent managing Sponsored Products Ads?

Up your ranking by 50 places?

All of these (and so many more) are great reasons to get involved with Amazon Advertising, but you must ask yourself what you want to accomplish and by when.

Without knowing this, you’re merely pitching money into mystery metrics and shuffling numbers and hoping for the best.

Grab Your Tool Kit and Build Better Campaigns

While it’s true that Amazon’s Campaign Manager provides many advertising resources, it’s also true that the tools offered there are less than optimal, often proving cumbersome, confusing, and limited.

Campaign management can (and we believe, should) be easier and faster and smarter, not to mention empowering and downright fun rather than a chore.

Your Amazon Advertising Advantage

Ignite is a fully integrated Amazon Sponsored Products ad-management platform.

The software is a balance of art (the look and feel and capabilities that sellers told us that they wanted in a campaign-management app) and science (historical data on millions of products and even more keywords and user search terms as well as intelligent suggestions based on this data).

It’s everything you can do with Amazon’s Campaign Manager, but cleaner, easier, faster, smarter, and with exclusive features that give you, and nor your competitors, the best placements and most sales.

Easily Create a Killer Campaign or Spark New Life Into an Existing One

We often hear from sellers that while they’re not happy with the Amazon’s Campaign Manager, they’re afraid to move away from the platform because they don’t want to have to start their existing campaigns all over and lose the history that they’ve built there.

The good news is that Ignite gives you a fresh start without making you start all over. Nothing is lost, everything is carried over.

How to Get Everything Set Up

Connect your Amazon account and marketplaces to Ignite (Ignite supports Sponsored Products management for 7 different Amazon marketplaces—within one interface).

This automatically adds your products to Ignite so you can create new advertising campaigns immediately.

As you’ll see when you connect, the Ignite interface is fully integrated with Amazon so there’s no toggling between apps and accounts and your Ignite creations and edits are reflected immediately on Amazon.

If you have existing campaigns in Seller Central and you want to centralize and consolidate those for easier management, import them into Ignite and watch the clutter become clarity as Ignite scans your campaigns, organizes them, and presents them cleanly and logically.

Ignite will then begin archiving your campaign data for historical analysis.

This means you’ll get a campaign’s lifetime history as opposed to other platforms’ standard 30-60 days worth of data.

That big-picture long-term perspective matters when making decisions going forward.

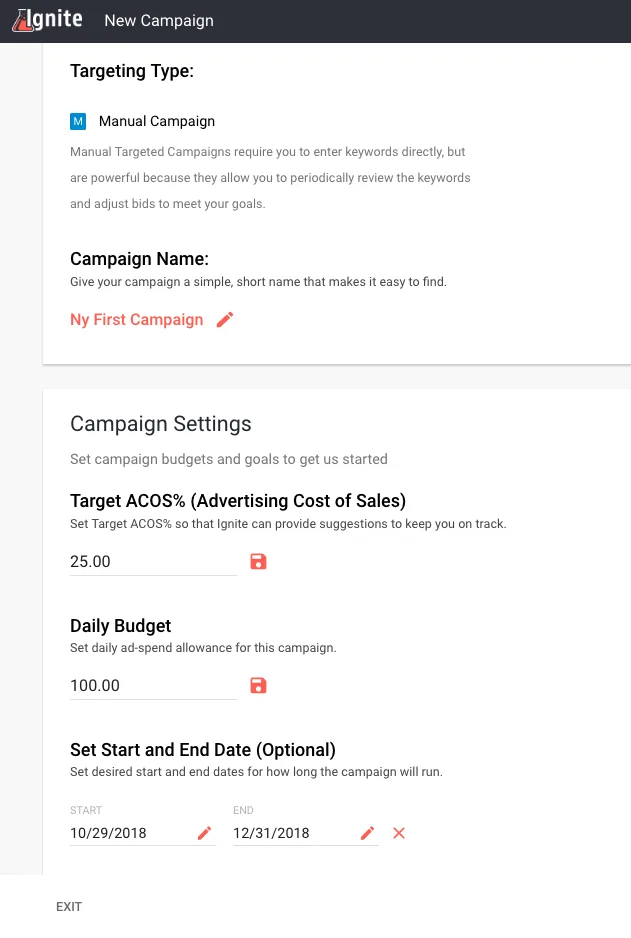

Configure Your Campaign and Give It a Name

If you’re brand new to Amazon Sponsored Products or you’re an existing user and you’d like to set up a new campaign, you’re ready to do just that and you can have it up and running within minutes.

Here you’ll choose a marketplace, campaign type, targeting type, and a name for your campaign.

A seller is shooting for lowest ACoS percentage possible.

But an ACoS percentage between 25%–40% is generally good.

This is where you can put a little of your own art into the campaign based upon what you know about your product, your competition, the larger field, and of course, your goals.

Now select a product to advertise and add it to the campaign (it’s as easy as adding it to cart).

We recommend one distinct product per campaign.

If you have a product with variations such as different colors, you can use a single campaign for all of those.

Right from here you can integrate your product into Ad Groups.

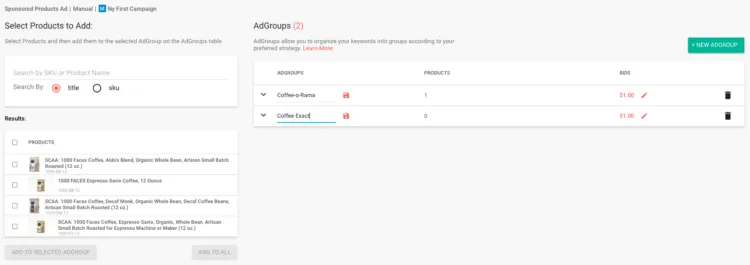

Create Your Ad Groups

This is where you’re going to create your ad-groups for your keywords.

Recall here the target graphic from earlier in this chapter and how it displayed the three main match types—Broad, Phrase, and Exact—in concentric rings with Exact Matches as the bullseye.

With that in mind, we recommend that you create an ad group for each of the three match types. Ignite can even do this for you by automatically creating the groups, populating them with the appropriately matched keyword suggestions, and even setting the default bid for all of those groups.

Keep in mind that all of this is under your control in a manual-target campaign and it’s really easy to reconfigure anything (or everything) as you see fit.

In fact, you’ll actually be doing some of that when it comes to optimizing your campaigns.

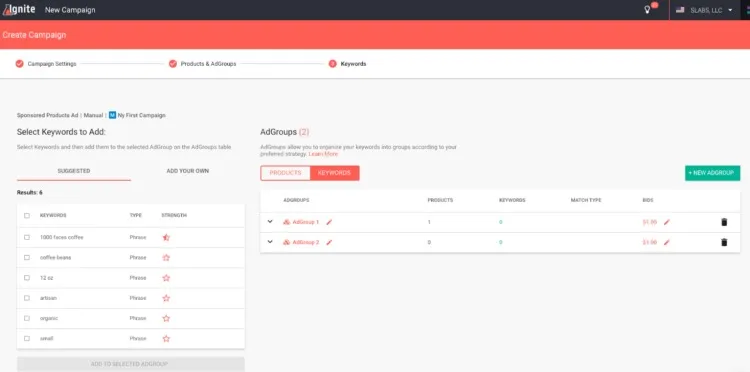

Determine Keywords and Match Types

Here’s where Ignite really starts to shine.

We’ve taken all of the data that we’ve collected over our many years in the industry—data about millions of products and user search terms and keywords and how those keywords rank, data that is constantly being added to and updated—and we’ve made it a built-in feature of Ignite.

So when you attach your product to a campaign, Ignite recommends keywords for the broad, phrase, and exact match ad groups.

In addition to the most relevant keywords and how we recommend grouping them, Ignite also lets you sort those keywords by position and score so that you know exactly which words you want to put your money on.

Better still, Ignite suggests which keywords you should make negative so you don’t incur any costly misleading clicks on those.

Now, wait for the results

After setting up an Ignite campaign, you’ll likely want to get back to it within 24 hours and see what the software has turned up and make immediate adjustments to your campaigns.

Resist the temptation to tinker.

While collecting data with Ignite doesn’t take nearly as long as it does with Amazon, it still takes some time and there is, of course, the up-to-48-hour delay just for Amazon to show sales.

If you want see stats such as impressions and clicks and get more familiar with the Ignite interface, check in and do so.

But in terms of making changes, sit tight, and resist the urge to tinker so early.

Give the tool 5-7 days to collect the necessary data, analyze it, and make recommendations based upon the information it has parsed.

Trust the process and let the tool do the heavy lifting behind-the-scenes.

Executive Summary

Amazon Sponsored Product Ads are a necessary aspect of selling on Amazon, especially if you are serious about growing your revenue through the marketplace.

Like all PPC platforms, Amazon Sponsored Product Ads are increasing in price and competition.

Tools like Ignite – though there are many others – can help you to automate this process and save money and time.

Of course, many sellers prefer to manage their campaigns on their own. And that’s perfectly fine, too. Use this guide as a helpful resource in understanding how your Amazon Sponsored Product Ad options, targeting choices and more.

And good luck!

Lena Liberman is a researcher, writer and educator at Seller Labs, where he digs in to Amazon’s most recent updates to educate novice and expert Amazon sellers alike on changes ranging from A9 algorithm updates to Amazon Advertising updates throughout any given year. In particular, Lena is an Amazon PCC management expert, using his research fundings to consult with brands and grow sales through the channel.