by Nicolette V. Beard

23/12/2024

The storey of online marketplaces is a testament to digital transformation. What began as modest ventures by entrepreneurs like Jeff Bezos and eBay's founder have become global economic powerhouses. Amazon started with a simple family loan, while eBay emerged as a programmer's hobby project. Today, these platforms generate billions in sales, symbolising a massive shift in consumer shopping behaviors.

The digital marketplace landscape has undergone a rapid and exciting evolution beyond the initial pioneers. Fuelled by convenience and global connectivity, marketplace platforms have exploded in number and scale. Current projections from Digital Commerce 360 indicate that sales from the top 100 global online marketplaces will reach an astounding $26.69 billion, a testament to the immense growth potential in this digital era.

China has emerged as a dominant force in this digital ecosystem. The country occupies three of the top five marketplace spots, representing 62% of worldwide third-party sales. This remarkable concentration highlights the global potential of digital marketplaces.

Even more impressive, third-party sellers are projected to generate $3.832 trillion in Gross Merchandise Value (GMV) by the end of 2024 — effectively doubling the market size in just six years.

With over 150 marketplaces now available, the expansion shows no signs of slowing. The immense opportunities represent new channels for online businesses to reach trillions in potential revenue. While the choices may seem overwhelming, understanding these platforms can unlock unprecedented growth for brands willing to adapt to this digital marketplace revolution.

Benefits of selling on online marketplaces

Online marketplaces have revolutionised how retailers connect with consumers, offering smaller businesses unprecedented access to global markets. These digital platforms transform traditional retail by bridging millions of retailers with billions of potential customers. In 2023, research from GlobalData revealed that 42% of ecommerce orders involved retail stores as fulfillment or pickup sites, underscoring the interconnected nature of modern retail.

If you're looking to get up to speed quickly and enjoy the halo effect of a trusted brand, online marketplaces represent an economical option to grow sales and a loyal customer base.

Fast to launch.

Entering online marketplaces offers a cost-effective and rapid pathway to growth. Once approved as a third-party seller, businesses can quickly upload product catalogues and start selling. Feed management technologies like Feedonomics can streamline product data optimisation and marketplace integration for companies with extensive inventories or those targeting multiple platforms.

Massive customer reach.

The scale of potential customer engagement is remarkable. Major platforms like Amazon Marketplace, eBay and Walmart Marketplace collectively attract nearly 3 billion active monthly visitors. Adding Chinese-based Taobao, the world's largest online marketplace by GMV, introduces 303 million monthly consumers to your potential customer base.

Established support programs.

Leading online marketplaces provide comprehensive programs to support sellers' marketing, sales and fulfillment strategies. Digital marketing tools like Amazon Advertising, eBay Promotions Manager and Google Shopping Actions help businesses showcase new products to targeted audiences effectively.

Similarly, fulfillment services such as Amazon's FBA and eBay Global Shipping enable sellers to leverage marketplace infrastructure, meeting consumer expectations for fast and free delivery.

By embracing these platforms, businesses can rapidly expand their reach, minimise operational complexities, and tap into established consumer networks with minimal upfront investment.

Top-tier online marketplace examples

In the dynamic world of digital commerce, strategic marketplace selection can unlock unprecedented growth opportunities. Each platform offers unique advantages for businesses seeking to expand their online presence and reach diverse consumer segments.

Amazon: The consumer information hub.

Amazon remains the premier destination for product research, with 75% of consumers consulting the platform before making purchases. With 200 million Prime members spending an average of $1,400 annually, Amazon represents a critical sales channel for brands. Accessing this massive consumer base can significantly boost revenue potential, whether through self-fulfillment or Fulfillment by Amazon (FBA).

Amazon's individual selling plan is enough for most marketplace sellers wanting to start immediately. However, if you want to sell collectibles, like coins or products like alcohol or tobacco, these products are restricted; you must have a professional plan and apply for permission. If you don't plan to sell more than 40 items per month, an Individual plan is a great option.

Walmart marketplace: Massive consumer reach.

Merchants selling on Walmart Marketplace will have access to more than 138 million monthly visitors, offering merchants access to a broad consumer base. The platform's strict entry requirements ensure a curated product portfolio. By complementing Walmart's existing product lineup, businesses can tap into a well-established retail ecosystem. If you feel your products complement Walmart's existing online portfolio, the first step is to fill out Walmart's application.

Target Plus: Exclusivity's appeal.

If you're looking to bask under Target's brand glow and attract a portion of Target.com's 200 million+ monthly visitors, it's worth taking the extra steps to snag an invitation to join this exclusive, vibrant marketplace. Unlike industry giants Amazon and Walmart, Target Plus curates its partners and products, ensuring top-quality offerings for shoppers. With fewer vendors, Target Plus represents a unique opportunity for your products to shine and your brand to break out in a crowded market. Once you gain access, you can combine the power of BigCommerce and Feedonomics to expand your omnichannel strategy.

eBay: Global market expansion.

eBay provides access to 168 million active buyers, generating $83 billion in annual GMV. The platform's presence in 190 markets enables businesses to explore international sales opportunities. Sellers can optimise listings and marketplace performance through tools like Feedonomics.

Etsy: Creative economy marketplace.

Distinguishing itself from traditional platforms, Etsy champions artisan and creative products. With 96 million active buyers and $2.74 billion in 2023 revenue, its bootstrapped days are well in the past. Selling on Etsy is a relatively low-risk way to start your business and test a concept before investing in building a website. The comprehensive Seller Handbook provides essential guidance for new and established sellers.

Social commerce platforms aid product discovery

Emerging social platforms are transforming how consumers discover and purchase products. These platforms, especially appealing to younger demographics, integrate shopping experiences directly into social interactions.

Instagram Checkout: The social shopping destination.

Instagram has transformed from a photo-sharing platform to a robust social commerce ecosystem. The platform evolved to shopping with the introduction of Checkout in 2019. This feature allowed users to complete purchases directly within the app. With 2 billion monthly active users worldwide, Instagram represents a massive opportunity for businesses to engage consumers through visual storytelling and seamless purchasing experiences.

BigCommerce offers native integration that simplifies the process of selling on Instagram. This integration removes traditional barriers between content consumption and purchasing, creating a frictionless shopping experience. If you already have a BigCommerce store, you can install Instagram here.

TikTok Shop: Viral social commerce economy.

TikTok has emerged as the world's most dynamic digital discovery engine, revolutionising how businesses connect with consumers. With over 2.2 monthly visitors, the platform has become a social commerce powerhouse, particularly for brands targeting younger demographics.

According to eMarketer's 2024 forecast, sellers can access 117.9 million US users, representing over one-third of the population. This unprecedented reach offers businesses a unique opportunity to engage with a highly active and digitally native audience. TikTok Shop represents more than just an ecommerce platform — it's a dynamic ecosystem that amplifies content creators and drives viral marketing.

Recognising the platform's potential, BigCommerce has partnered with TikTok to offer TikTok for Business. This collaboration provides merchants in the US, UK, Australia and Canada with a free, one-click integration through Channel Manager, lowering the barriers to entry for businesses seeking to leverage this innovative marketplace.

Facebook Shop: Seamless social selling.

Facebook Shop transforms social media interaction into a streamlined shopping experience. Integrated directly within Facebook Pages, the platform enables businesses to create online stores that allow customers to browse and purchase products without leaving the social network.

Companies can leverage their existing Facebook Page or create a new one to establish a distinct brand presence. The platform's integrated payment processing simplifies transactions, though availability varies by region.

This approach offers more strategic marketing potential than traditional Facebook Marketplace selling. One of Facebook Shop's significant advantages is the ability to redirect customers to external ecommerce websites, allowing businesses to use the platform as a discovery tool while maintaining control over their broader omnichannel strategy.

Regional marketplaces deliver targeted growth

Mercado Libre: Regional targeting at scale.

For ecommerce retailers, Mercado Libre represents your gateway to 635 million online shoppers across 33 countries. They launched their Global Selling Programme to make online selling internationally simple. In addition to providing easy access to this burgeoning market, the programme helps US retailers sell in USD without currency fluctuations. BigCommerce's Channel Manager platform ensures that our existing merchants across the US put their best foot forward as they build their loyal consumer base in the region.

SHEIN Marketplace: Brand-aligned opportunity.

Once known solely as an ecommerce retailer, SHEIN launched a US marketplace, evolving to become a broad-category retailer and marketplace hybrid. They offer brands another way to optimise their omnichannel business model through channel diversification. BigCommerce seamlessly integrates SHEIN's data from your ERP and PIM, giving you comprehensive insights to meet the growing expectations of a unified customer experience.

Niche marketplace audiences and sales add up

Niche marketplaces and specialised ecommerce platforms have gained traction in recent years, demonstrating the diverse landscape of ecommerce business. Many platforms are finding success by focusing on specific product categories or consumer segments. Their growth rates and strategic expansions indicate a positive trend in the ecommerce market, particularly for platforms that cater to underserved markets or offer unique value propositions.

Bonanza.

Bonanza offers a wide range of products across various categories, including fashion, hobby and leisure, and furniture and homeware. Their 25,000 merchants sell primarily in the United States. In 2023, Bonanza's online GMV equaled $130.2 million. They are actively working on increasing buyer traffic and conversions and enhancing platform features.

Fruugo.

Fruugo specialises in cross-border ecommerce sales, with over 96% of its transactions crossing borders and more than 90% of revenue generated from shoppers outside the UK. The number of shoppers using Fruugo increased by 114% to nearly 7 million.

Zalando.

This major European fashion and lifestyle ecommerce platform is committed to helping its partners grow and taking a personal interest in the success of every brand. Merchants can bring their offline stock online, too. With Connected Retail, brick-and-mortar stores can access millions of online customers and benefit from added visibility and sales. The platform reported strong growth for 2024. All indications are that it's firing on all cylinders.

FullBeauty.

This unique marketplace is a digital mall housing all of Full Beauty's brands. Their innovative universal cart technology allows shoppers to browse and buy from all the brands within the digital mall in one seamless shopping experience and transaction. Their vision is to be known and trusted as the authority on plus size fit and fashion.

Tanga.

Since 2006, Tanga has excelled as a marketplace for savvy shoppers seeking unbeatable deals. Sellers can list all or part of their inventory, supported by automated tools for seamless product management. Integration with inventory systems prevents overselling, while Tanga strategically prices items to attract budget-conscious buyers.

Through personalised emails, online campaigns and mobile advertising, Tanga connects products to a growing audience of deal enthusiasts, ensuring maximum exposure and sales.

Essential steps to leverage your online marketplace success

Dominating online marketplaces requires more than just listing your products; it's about implementing key strategies that consistently drive results and address the demands of each platform. Follow these essential steps to build a sustainable and profitable presence across multiple marketplaces.

Let's start with the foundational aspect of profitability.

Calculate profits: Understanding marketplace selling fees.

Each online marketplace has unique seller transaction fees, commission fees and requirements. These can be complex, and failing to understand them upfront can severely impact your profitability.

Some marketplaces charge listing fees (Amazon: $0.99/listing, Etsy: $0.20/listing), while others like eBay and Walmart don't. eBay charges a final value fee based on the final price (which includes shipping and sales tax), but it varies based on category.

Beyond listing fees, consider monthly fees, closing fees, referral fees, commissions, transaction fees, regulatory operating fees and fulfillment fees — all of which vary by platform and product category.

Note that similar fees might differ across marketplaces, so always conduct thorough due diligence. Ultimately, weigh the size of the marketplace's customer base against the sales volume needed to generate a profit.

Think of these marketplace expenses as the cost of doing business; your choice of marketplace should align with your business objectives and the variable seller costs you're willing to absorb.

Diversify your shipping strategy: Meeting customer expectations.

Amazon has set a high bar for free and fast shipping (sometimes same-day), influencing customer expectations across all marketplaces. Research shows that over 80% of customers prioritise free shipping, while significant percentages abandon carts due to slow (18.66%) or late (27.44%) deliveries. Without a cost-effective shipping strategy, fulfillment costs can quickly erode profits.

Therefore, access to competitive carrier pricing and diverse delivery options is essential. Consider using a mix of UPS, FedEx, and USPS, selecting the carrier best suited for each order based on deliverability guarantees and cost.

Optimise fulfillment and logistics: Streamlining operations.

The logistical complexities of ecommerce can be overwhelming. Many merchants lack the resources or desire to manage their warehouses. Fortunately, solutions exist. Software that integrates with online marketplaces simplifies order management across all sales channels, eliminating manual uploads and data entry duplication.

Consider utilising services like Amazon FBA (Fulfillment by Amazon) or third-party logistics (3PL) providers such as ShipBob or ShipStation. These options provide scalable and efficient fulfillment solutions, allowing you to focus on other aspects of your business.

Scale with feed management software: Automating product listings.

As you grow and expand across marketplaces, a tool to synchronise product data becomes critical. You've invested time optimising product titles, descriptions and categories; feed management software ensures this consistency across all platforms.

Product categorisation varies greatly between marketplaces; software automatically maps your products to the correct categories, saving you significant time and effort. Services like Feedonomics can further optimise your listings for increased sales and visibility. Remember, there's a difference between product listings seen and listings bought; compelling product content is the key differentiator. Focus on keyword research, compelling descriptions, optimal categories, and high-quality images.

Integrate with existing ecommerce platforms: Managing growth.

Expanding to multiple marketplaces requires a streamlined approach. Utilising an ecommerce platform designed for multi-marketplace integration simplifies the process. Instead of repeatedly uploading product data, you input it once and then designate which marketplaces to share it with. Doing this improves efficiency and significantly reduces the risk of errors.

Know marketplace rules and regulations: Avoiding penalties.

Navigating the rules and regulations of online marketplaces requires a nuanced understanding beyond simply listing products. Significant differences exist between regions; even within regions, individual marketplaces can have unique requirements.

Each marketplace has its terms of service, seller policies and prohibited items list. Familiarising yourself with these platform-specific rules is paramount for avoiding account suspension or penalties. These rules often change, so regular review is necessary.

Merchants must conduct thorough research tailored to each target market and marketplace. Failing to comply with these rules, regulations, data privacy and taxation can lead to significant financial penalties, legal action, account suspension and reputational damage.

We strongly recommend consulting with legal and tax professionals specialising in international ecommerce for businesses operating in multiple regions. Regular updates and vigilance are vital to staying compliant in this evolving regulatory landscape.

Communicate with your customers: Announce your marketplace presence.

Finally, remember to inform your existing customers about your new marketplace presence! Use your website's email marketing, social media announcements or call-to-action buttons. Let them know where they can now find and purchase your products.

By diligently implementing these steps, you can significantly increase your chances of success on online marketplaces. Remember that ongoing adaptation, data analysis, and a customer-centric approach are crucial for long-term growth and profitability.

Reach global marketplace audiences

In the introduction, we referenced the significance of global online marketplaces, but it bears repeating: Third-party sellers are projected to generate $3.832 trillion GMV in 2024.

Expanding to reach a global audience is not a matter of if; it's a question of when. The upside is too huge to ignore.

Asia-Pacific

The Southeast Asia region, commonly called APAC, is witnessing a remarkable surge in online shopping, solidifying its position as a global ecommerce powerhouse. Home to the world's largest population, the region's sustained growth is driven by the dominance of several key marketplaces:

Alibaba.

A leading online marketplace in China, Alibaba is a name that online providers should be familiar with. It attracts 73.6 million monthly visitors, ranking No. 16 for marketplace websites worldwide, according to SimilarWeb data.

AliExpress.

AliExpress, a subsidiary of Alibaba, is an online retail service based in China. Its service range extends to Russia, where it is one of the most visited ecommerce platforms in the country.

Amazon China.

Amazon China is an online platform headquartered in China. Formerly known as Joyo.com, Amazon purchased and renamed the company in 2004. However, unlike other marketplaces in the region, since 2019, Amazon China has focused on cross-border selling to Chinese customers as opposed to domestic sales.

Rakuten.

Rakuten is a Japanese ecommerce and online retailing company that boasts more than 544 million monthly domestic visitors. Though it is sometimes called the Amazon of Japan, Rakuten has offices worldwide.

Taobao.

Taobao is a Chinese online marketplace. Like AliExpress, it is a subsidiary of Alibaba. Taobao separates itself from the other Alibaba subsidiaries by focusing primarily on C2C sales channels instead of B2B. It launched as a competitor to eBay China before eventually overtaking it and forcing eBay to exit the market.

TMall.

TMall, formerly Taobao Mall, is yet another subsidiary of Alibaba. Unlike Taobao, which spun off in 2011, TMall focuses primarily on direct-to-consumer (D2C) business. With a significant user share of 58%, TMall is one of the top three online shops in China.

Europe

Europe and the European Union compose the third largest market in the world. Though recent privacy laws like GDPR have complicated marketing efforts, online marketplaces have flourished, and industry watchers expect them to continue to grow.

Amazon Germany.

Amazon is the dominant marketplace in Germany, with an impressive 81% market share.

La Redoute.

La Redoute is a French multichannel retailer. Founded in 1837, it is one of France's most prominent fashion and apparel ecommerce sites, with more than 7 million monthly visitors.

Otto.

The Otto Group is one of the largest online shops in Germany, ranking second behind only Amazon in revenue. In its most recent filings, Otto Group reported online sales of around EUR 10.8 billion (2023/24 financial year).

Zalando.

Zalando is a German-based ecommerce organisation that ranks as Germany's leading fashion ecommerce marketplace. Revenue grew to 2.2 billion euros generated in Q3 2024.

Latin America

The Latin American region is another quickly growing ecommerce marketplace. With an incredible 36.7% sales growth from 2019 to 2020, the region swiftly outpaced expectations, primarily due to the following organisations:

Mercado Libre.

Dubbed the "Amazon of Latin America," Mercado Libre has grown exponentially as the region's leading online marketplace.

Amazon Mexico.

Launched in 2013, Amazon quickly blossomed, becoming the second-largest ecommerce platform in Mexico with a 57% user share.

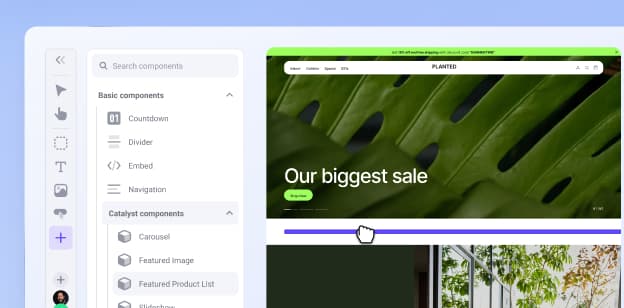

How BigCommerce supports selling on marketplaces

Taking complexity and simplifying it is one way our technology supports merchants. Through pre-built integrations and API partnerships, retailers can expand their reach to diverse marketplaces. From instant commerce to a marketplace channel manager, BigCommerce gives your business a robust ecommerce foundation to succeed online.

Omnichannel management.

You can easily connect to popular shopping sites like Amazon, eBay, Walmart, and Google without navigating between websites. BigCommerce's omnichannel management system helps you manage everything about your products — from creating listings and running ads to shipping orders. Best-in-class tools like Feedonomics give shoppers the product information they need to complete their orders, leading to higher sales. The tool can even enable in-store pick-up or same-day delivery on online marketplaces in a blink, impressing customers with the speed of delivery.

Real-time inventory sync and order management.

When you sell on multiple marketplaces, BigCommerce keeps track of everything in one place. It automatically updates your inventory whenever you make a sale, so you won't accidentally sell something out of stock. You can also change prices across all your stores at once. Instead of managing orders on multiple marketplaces, you'll see them all in one dashboard, making it much easier to ship products and help customers.

Payment and shipping solution integrations.

Convenience comes first with customers, and BigCommerce makes it easy for merchants to deliver. When they buy your product on a marketplace, they can pay however they want, whether with a credit card, digital wallet or local payment method. The platform also works with various shipping carriers, so buyers can see exactly how much shipping will cost before they check out. And if your customers want to pay in their currency or send items to different addresses, that's no problem — BigCommerce handles everything smoothly.

Want to Expand Your Omnichannel Strategy?

Download our Omnichannel Guide and see how easy it is to grow into new marketplaces, social channels and search engines.

The final word

The digital marketplace revolution continues to reshape retail, with third-party sellers projected to generate $3.832 trillion in sales by 2024. Today's landscape offers unprecedented reach — from Amazon's 200 million Prime members spending $1,400 annually to Walmart's 138 million monthly visitors. Even regional players pack a punch, with Mercado Libre connecting sellers to 635 million shoppers across 33 countries.

Modern tools have made success more achievable than ever — 42% of orders now involve retail stores for fulfillment, showing how digital and physical retail can work together. Whether you choose established giants or emerging platforms, the technology exists to manage inventory, optimise listings and scale globally.

Like the early internet pioneers who transformed modest ventures into global powerhouses, today's marketplace revolution offers an exciting frontier for business growth.

FAQs about ecommerce marketplaces

Nicolette V. Beard

Nicolette is a Content Writer at BigCommerce where she writes engaging, informative content that empowers online retailers to reach their full potential as marketers. With a background in book editing, she seamlessly transitioned into the digital space, crafting compelling pieces for B2B SaaS-based businesses and ecommerce websites.