by Nicolette V. Beard

23/04/2025

The automotive industry has transformed dramatically over recent decades, with ecommerce markets booming across both B2C and B2B channels. From individual consumers shopping for vehicles and accessories to parts distributors supplying service centers and fleet managers, buyers are shifting toward digital experiences — fundamentally changing how cars and components are bought, sold, and serviced worldwide.

Experts project that automotive ecommerce will reach $267.8 billion by 2032, expanding at 16.5% CAGR from 2025 onward. Several factors fuel this exceptional growth — from widespread smartphone adoption and AI-powered shopping journeys to immersive AR showrooms and intelligent fitment tools that support both consumer and professional buyers.

Buying cars online shows no signs of slowing. Pandemic-era disruption accelerated the shift toward digital channels, making online research, purchasing, and even bulk ordering the norm. A recent Cox Automotive survey reveals that while half of US car buyers still complete their purchases entirely in person, 43% mix digital and in-person steps — and nearly one-fifth say they’d prefer to complete their entire transaction online.

Meanwhile, B2B buyers — such as repair shops, national distributors, and speciality mechanics — increasingly expect the same intuitive shopping experience, complete with features like VIN lookup, cross-referencing, and serialised part tracking. In the US alone, ecommerce sales of motor vehicles and auto parts exceeded $560 billion in 2022, with B2B digital sales representing nearly half of all wholesale activity in the segment — a clear signal that professional buyers are embracing digital channels. Ecommerce platforms that can deliver these capabilities at scale will define the next wave of growth.

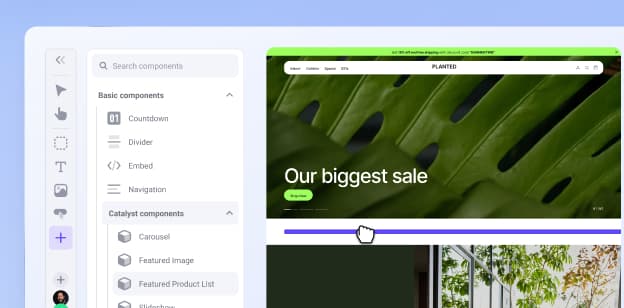

With solutions like BigCommerce’s specialised automotive ecommerce platform, businesses can streamline operations and meet the unique needs of both B2B and B2C buyers. From optimised fitment data and extensive product catalogues to custom pricing and ERP integrations, digital tools are now essential for success in this evolving space.

As the lines between retail and wholesale continue to blur, investing in ecommerce infrastructure isn’t just a competitive advantage — it’s a necessity for long-term growth in the automotive industry.

Shifting gears to ecommerce

The automotive industry has shifted into high gear online, propelled by both consumers and B2B buyers who increasingly prefer digital shopping experiences. Platforms like Amazon and eBay have become bustling marketplaces where shoppers — from DIY enthusiasts to professional mechanics — browse for everything from small components to complete vehicles.

Market Research Future valued this transformation at $71.3 billion in 2023, projecting growth to $199.5 billion by 2032 at an impressive CAGR of 18.4%. This momentum is fuelled by demand for easier purchasing, better pricing, and broader selection — benefits valued by individual buyers and wholesale customers alike.

Source: Market Research Future

Marketplaces have played a central role in this growth. For consumers, they offer easy access to product reviews, quick shipping, and familiar checkout experiences. For businesses, they provide a way to source parts on demand, compare prices, and extend their own reach. In fact, B2B marketplace sales surged by 131% in 2021, reaching $56.5 billion — a sign of how quickly digital adoption is accelerating across all types of buyers.

Still, many businesses are choosing to invest in owned ecommerce channels. DTC and B2B strategies allow for more control over the brand experience and deeper relationships with customers. Fortune Business Insights projects the global automotive ecommerce market will grow from $100.14 billion in 2024 to $343.13 billion by 2032 — with digital channels expected to account for more than half of B2B revenue by 2025.

Technology is central to this evolution. AI-powered forecasting, smart warehousing, and optimised shipping have made it easier than ever to run efficient operations. Increased smartphone usage and flexible payment tools have further accelerated adoption for shoppers of all types.

Artificial intelligence also helps sellers manage large inventories more effectively. The ecommerce automotive aftermarket alone is expected to reach $215.6 billion in 2024, with marketplaces capturing nearly 40% of that share. Intelligent systems categorise products, learn from purchasing patterns, and adjust stock levels to reduce waste and prevent stockouts.

Brock’s Performance experienced these benefits firsthand when they discovered how technology could support its network of 1,200 motorcycle dealers worldwide. The complexity of their products had previously created headaches until they implemented specialised tools that simplified operations. Their team members shifted focus to growth-oriented activities that expanded their business horizons.

Accelerate Your Automotive Sales

Discover a specialised ecommerce platform built for automotive brands—streamline your operations and boost conversions.

Benefits of automotive ecommerce

Like many others, the automotive industry has rapidly shifted toward online sales, compelling even traditionally brick-and-mortar businesses to embrace ecommerce. This pivot presents substantial benefits for both consumers and businesses, driving revenue growth across the entire value chain.

1. Personalise the customer experience.

These digital platforms revolutionise shopping experiences through tailored interactions that customers increasingly desire — whether they’re weekend DIYers or professional buyers. Ecommerce systems analyse purchase history and vehicle specifications to suggest perfect-fit products. Imagine searching for brake pads and receiving recommendations for compatible rotors specifically designed for your Jeep Cherokee — or for an entire fleet of light-duty trucks.

Customers might discover special discounts through mobile notifications when visiting physical stores, creating seamless online-offline connections. B2B buyers can access pre-negotiated pricing, saved shopping lists, and quick order forms that streamline recurring purchases and simplify bulk ordering.

Diagnostic capabilities transform vague descriptions like "strange knocking sound when accelerating" into precise part suggestions, empowering buyers — whether individual car owners or trained technicians — to solve problems independently. Vehicle information and browsing behaviour enable platforms to predict needs before shoppers even recognise them. Advanced compatibility tools virtually eliminate returns by ensuring parts match specific makes and models.

Customised journeys foster deeper brand connections while dramatically increasing purchase completion rates. Recognising individual preferences — or business-specific purchasing workflows — demonstrates genuine interest in customer success, distinguishing forward-thinking companies from their competition.

User experience continues evolving with designs that perform flawlessly on phones, tablets, and computers. Efficient checkout processes with minimal forms and diverse payment methods, including purchase orders or net terms for B2B buyers, significantly reduce abandoned carts. Helpful chatbots answer questions instantly, guide purchase decisions, and troubleshoot issues throughout the shopping experience, boosting conversion rates across all customer types.

2. Expand customer base.

Car dealerships and parts sellers traditionally served local markets through regional advertising. Ecommerce eliminates geographic barriers, enabling customers — from individual consumers to commercial buyers — to shop across regions or nationwide instead of relying solely on local suppliers. For B2B sellers, this opens opportunities to serve a broader range of buyers, from independent repair shops to fleet managers and speciality mechanics.

As businesses pursue global expansion, digital marketplaces serve as critical platforms for achieving cross-border reach. Automotive companies can now access new markets and serve a broader customer base from anywhere — without building physical infrastructure in every region.

Automotive ecommerce: ripe for global expansion.

The automotive sector offers rich opportunities for global expansion with several compelling advantages.

Passionate car enthusiasts worldwide often seek rare or high-performance parts that can’t be found in local markets, creating strong international demand. At the same time, B2B buyers — including national distributors or service networks — may source parts internationally to access better pricing, fill supply gaps, or meet unique performance requirements. Loyalty to specific brands drives both types of buyers to search globally for authentic components, regardless of where they’re located.

Many consumers and businesses will eagerly import products from overseas when their preferred manufacturers are unavailable locally. Geographic price differences present another key opportunity, as identical components may cost substantially less in certain countries due to manufacturing efficiencies, regulatory variations, or local market conditions.

Value-conscious buyers frequently look beyond borders to secure better deals on quality parts. Cross-border commerce in the automotive industry thrives when businesses provide specialised components that fill regional gaps — whether that’s a rare upgrade kit for a car enthusiast or a specific OEM part needed by a commercial fleet.

Marketplaces in cross-border automotive ecommerce.

Marketplaces function as established channels that connect sellers with global customers. They deliver built-in infrastructure, trust, and shipping solutions that dramatically reduce the obstacles to international expansion — especially for businesses just starting their global journey.

Listing products on platforms like Amazon or eBay instantly exposes your inventory to millions of international buyers. Whether you're selling directly to consumers or supplying parts to other businesses, established marketplaces lend added credibility and simplify the cross-border buying process.

Fulfillment services offered by these platforms often handle everything from warehousing to international delivery, reducing the logistical challenges that come with global sales. Marketplace systems also simplify multi-currency transactions and offer built-in marketing tools to drive additional traffic to your listings.

For B2C and B2B automotive brands alike, these advantages create an accessible pathway to grow beyond local markets without overwhelming internal resources.

3. Cut costs and streamline operations.

The automotive industry has radically transformed through ecommerce, reshaping market reach and supply chain fundamentals. Traditional dealerships require vehicles to occupy expensive real estate until purchased. Digital platforms, however, allow companies to showcase inventory directly from factories or warehouses. This reduces the need for physical space and allows both consumers and B2B buyers to browse broader selections online.

Ecommerce delivers another decisive advantage beyond inventory expansion: operational streamlining and substantial cost reduction. The shift stems from connected systems, automation capabilities, and cloud infrastructure. Conventional operations often rely on paper-heavy processes and disconnected systems. Digital solutions integrate these functions across departments — from inventory and order management to customer communication — dramatically lowering overhead.

Automation plays a crucial role in this transformation. Routine functions like processing orders, managing bulk shipments, generating quotes, or handling recurring B2B purchases can run through specialised software, freeing up staff to focus on strategic tasks. Well-designed APIs enhance efficiency by connecting ecommerce platforms with ERP, OMS, and PIM systems — breaking down data silos and reducing errors across workflows.

At the centre of this streamlined approach stands cloud technology. These platforms provide scalable infrastructure that supports everything from product catalogues to team-based account management and customer service. Hardware costs diminish as expensive on-site systems become unnecessary, simplifying IT maintenance for businesses of all sizes.

Accurate inventory tracking and automatic reordering are essential for both B2C and B2B success. Imagine the consequences of incorrect stock information: a customer orders a critical part, only to find it unavailable. Real-time inventory updates prevent these disconnects, improving buyer satisfaction and trust.

Automatic reordering based on set thresholds or predictive analytics ensures that fast-moving or high-demand components remain in stock. For businesses managing large catalogues or serving repeat buyers, this reduces downtime and missed opportunities. A properly integrated system transforms the automotive supply chain, cutting costs, increasing efficiency, and enabling more profitable, customer-centric operations.

4. Drive revenue through omnichannel selling.

Automotive sales have experienced remarkable revitalisation through omnichannel strategies nationwide. Parts retailers who embrace websites, marketplaces, and social platforms gain substantial benefits alongside their customers. By selling across multiple channels, businesses dramatically expand their reach, tapping into diverse customer segments and increasing brand visibility. A customer might discover a needed part through social media, research it further on a dedicated website, and ultimately purchase it through a marketplace with a preferred payment method.

B2B buyers follow a similar journey — discovering products on marketplaces or supplier catalogues, saving items to shared carts, or requesting quotes directly from branded storefronts. For parts distributors, ensuring consistency in product data, availability, and pricing across all channels is critical to supporting large-volume buyers and recurring orders.

Integrating online and offline experiences creates harmony, moving away from the siloed efforts of a local dealership or even a single online shop. This ultimately gives both the customer and the retailer more options along the path to conversion, raising potential revenue and elevating the user experience. The added convenience of shopping on familiar platforms combined with an expanded selection naturally encourages faster purchasing decisions.

Brand loyalty strengthens through consistent messaging across every channel, building essential trust. Ultimately, omnichannel selling in the automotive industry unlocks a more seamless, personalised, and profitable shopping experience for everyone involved.

Digital tools transforming automotive ecommerce

The automotive industry's digital transformation has dramatically altered how cars, parts, and accessories reach customers — whether they're consumers customising a personal vehicle or business buyers sourcing parts for resale or fleet maintenance. Four essential components drive this change: visual branding, product configurators, 3D viewing technologies, and account-based buying for B2B customers. Together, these elements create engaging experiences, tailor interactions, and boost sales across both B2C and B2B channels.

Visual branding.

Creating a unified visual identity matters deeply for automotive websites. Consistency across digital channels strengthens brand recognition and builds trust — not just with individual consumers but also with B2B buyers who may place high-volume or recurring orders. Logos, colours, typography, and imagery should reflect a brand’s values while resonating with both end-users and professional buyers. Distinctive visual elements help businesses stand out in a crowded marketplace, drawing in visitors who may become loyal customers or long-term wholesale partners.

Product configurators.

Customers gain power through interactive 3D configurators that let them customise vehicles or parts on screen. Users can select different colours, trims, wheels, and interior options in real time. This hands-on experience deepens engagement and often speeds up decision-making. For B2B buyers — such as repair shops or speciality mechanics — configurators can streamline quoting, simplify variant selection, and preview product applications before bulk purchasing.

BigCommerce customer BB Wheels offers a strong example by bringing their physical showroom into the digital realm. Their Vehicle Visualiser helps customers see how specific wheels will look on their car model before purchasing.

3D viewing technology.

Immersive experiences emerge from cutting-edge 3D viewing tools, allowing shoppers to explore vehicles or parts thoroughly. Features like 360-degree views enable users to rotate items, zoom in on details, and scrutinise features with precision. For B2B buyers, especially those managing inventory or sourcing speciality components, these tools offer clarity and reduce the risk of ordering errors. Auto Showroom exemplifies this approach with interactive experiences that enhance online shopping journeys for all types of buyers.

Augmented reality takes visualisation further by placing virtual cars in actual environments. Shoppers can see how vehicles might look in their driveway — or how branded parts might appear on showroom floors or fleet vehicles — connecting digital exploration with real-world context and increasing purchase confidence.

Account-based buying for B2B customers.

While many features of ecommerce benefit both B2C and B2B buyers, commercial customers often require additional functionality to meet operational needs. For example, repair shops, distributors, and fleet maintenance teams may order in bulk, rely on internal approval workflows, or need quotes before purchasing.

Modern B2B ecommerce platforms like BigCommerce allow sellers to offer account-based experiences with flexible pricing, purchase order payments, and user-specific roles. Features like shared carts, saved shopping lists, and quote requests help B2B buyers streamline procurement. Buyers can also manage tax exemptions and net terms within their accounts, making reordering simple and scalable.

By supporting these account-level workflows, automotive businesses can better serve large or recurring customers and drive higher lifetime value from their B2B relationships.

Top automotive website examples

Below are examples of automotive brands focused on creating exceptional customer experiences.

How to boost automotive ecommerce sales

The shift to automotive ecommerce is accelerating, making it an essential strategy for businesses that once relied on brick-and-mortar locations. As the industry moves online, success depends on knowing where to find potential customers and how to capture their attention. Leveraging social media, digital advertising, and online marketplaces can drive sales and build a strong digital presence — whether you're selling directly to consumers or to commercial buyers like repair shops, fleet managers, or speciality mechanics.

1. Social media.

Social media is an ever-present force in American society today, making it a crucial tool for automotive ecommerce brands. By establishing a strong presence on platforms like Instagram, TikTok, and YouTube, companies can increase awareness, foster engagement, and ultimately drive sales — both to end customers and business buyers researching components or sourcing new suppliers.

Instagram: Visual storytelling and community building.

The highly visual nature of Instagram perfectly suits automotive businesses showcasing vehicles and aftermarket parts. Stunning photographs, carousel posts, and stories allow companies to display products in action — from DIY installations to fleet upgrades. For B2B sellers, visual content that explains fitment, variant options, or use cases can help commercial buyers better understand the products they’re purchasing in bulk.

TikTok: Viral content and trend-driven marketing.

Creativity and engagement receive rewards from TikTok's algorithm, making it an ideal space for automotive brands. Short-form videos featuring product unboxings, installation walkthroughs, or shop-based reviews help both consumers and professional buyers discover what sets your products apart. Distributors and performance shops may even showcase their own installations, building credibility through real-world content.

YouTube: Long-form content and in-depth reviews.

As both a video platform and search engine, YouTube is a go-to platform for car buyers, mechanics, and commercial parts buyers. In-depth product reviews, comparison guides, and technical walkthroughs support more complex purchasing decisions — especially for B2B buyers evaluating performance specs, part compatibility, or bulk ordering options.

Influencer partnerships: Showcasing aftermarket parts.

Automotive influencers provide an effective way to reach highly targeted audiences. While many focus on consumer installations or performance upgrades, others run repair shops or performance tuning businesses — making them trusted voices for both B2C and B2B audiences. Brands can partner with influencers to demonstrate features, durability, and real-world use cases that appeal to both weekend warriors and professional buyers.

2. Digital ads.

From TikTok ads to Instagram Shopping, digital advertising has evolved beyond traditional display ads. AI-driven creative, paid search, and feed management tools enable brands to reach both consumers and buyers with tailored messaging.

PPC landscape.

Automation influences everything from campaign structure, optimisation, bid strategies, and targeting to content creation. With Google Ads retiring Enhanced PPC and enforcing automated bid strategies on advertisers, businesses must fully embrace and adapt to these changes. Whether targeting individual consumers or commercial buyers like repair shops and fleet operators, advertisers can use automation to improve efficiency and reach high-intent audiences across both B2C and B2B segments.

Product feed management.

Sophisticated automation enhances PPC performance, allowing for real-time adjustments and customisation — giving advertisers greater control over ad spend. For B2C campaigns, product feed management tools like Feedonomics, help optimise listings based on engagement and purchase behaviour. For B2B, it enables businesses to promote bulk-order SKUs, highlight technical specifications, and tailor messaging by customer type. AI-driven feed tools improve product data quality, ensuring titles and descriptions are both accurate and compelling across use cases. Additionally, features like A/B testing, real-time optimisations, and advanced mapping and categorisation support continuous refinement, maximising return on ad spend regardless of audience.

Dynamic creatives.

Automation in dynamic creatives enables ad platforms to generate, optimise, and tailor ads for different placements and audiences, saving businesses time and resources. For B2C, this means delivering eye-catching visuals and personalised messaging based on browsing behaviour or lifestyle interests. For B2B, creative automation supports segmented campaigns by buyer type, industry, or product use case — from performance parts for auto enthusiasts to bulk orders for service centers. AI-driven tools automatically generate variations, enhance imagery, and adapt messaging for multiple channels, helping brands deliver high-quality creative at scale across both retail and commercial audiences.

3. Integrating into marketplaces.

Using established marketplaces such as Amazon, Walmart, and eBay, automotive companies can tap into massive built-in audiences — whether targeting individual consumers or B2B buyers.

However, meeting revenue goals requires more than simply listing products. You need a strategic approach. Structured product data and marketplace-specific SEO are critical for visibility across both consumer and business search journeys. It's the key to unlocking your products' potential to be found by the right customers — regardless of order size or buyer intent.

Improved search engine rankings.

Relevance drives success in marketplace search engines. These systems favor listings with clear, structured attributes — such as brand, fitment, or vehicle type — making structured data essential for visibility. For B2C shoppers, well-optimised listings surface more easily during product discovery. For B2B buyers, such as service centers or distributors, keyword-rich specs and part numbers enable faster sourcing and improved accuracy. As marketplace algorithms evolve to better understand customer intent, high-quality product data ensures your listings appear when either type of buyer searches for what you offer.

Enhanced product discoverability.

Structured data enables the filtering functions that both consumers and business buyers rely on. Shoppers browsing by size, brand, or price — and B2B buyers searching by technical spec, compatibility, or SKU — depend on properly formatted attributes to narrow down options. Recommendation engines also use this data to serve complementary products, increasing exposure and boosting average order value. Without it, even great listings risk being missed during filtered searches or suggestion flows.

Higher conversion rates.

Buyers need confidence before purchasing — whether it's a consumer replacing a part or a business restocking for commercial use. Structured data helps build that trust by answering key questions upfront, reducing hesitation and minimising support enquiries. For B2B buyers, clear specs and compatibility details help ensure the product meets operational needs and streamlines the purchasing process. Well-organised product pages create a more intuitive shopping experience and naturally drive higher conversion rates across buyer types.

Competitive advantage.

Most sellers fail to fully optimise product data, creating opportunities for you to gain a competitive edge through better organisation. B2C brands benefit from stronger visibility and engagement, while B2B sellers gain ground by offering searchable, spec-rich listings tailored to professional buyers. As marketplaces frequently update their requirements and ranking factors, businesses that prioritise data quality are better positioned to adapt and maintain visibility — even as algorithms evolve. Investing in structured product data gives your brand staying power across segments.

4. Customer reviews.

Customer reviews are a cornerstone of successful ecommerce, and this is especially true in the automotive industry. Buyers — whether individuals purchasing parts for personal vehicles or businesses sourcing inventory for resale or repair — often face significant uncertainty when shopping online. Reviews help alleviate this anxiety by providing social proof, building trust, and influencing purchasing decisions across both B2C and B2B transactions.

Here’s a breakdown of common review collection methods and their impact on automotive ecommerce sales:

Google reviews.

Google reviews drive automotive ecommerce sales by appearing prominently in search results and Google Maps, expanding your digital footprint beyond traditional advertising channels. Positive reviews directly improve local search rankings — critical for both dealerships and parts suppliers competing in specific geographic markets. Whether it’s a consumer evaluating a new accessory or a service shop sourcing from a new distributor, star ratings in search results increase trust and click-through rates. Most importantly, buyers across the board trust Google reviews, making them a powerful third-party validation tool at every stage of the buyer journey.

TrustPilot.

TrustPilot reviews help increase automotive ecommerce sales by offering transparent, unbiased customer feedback. When featured on product or brand pages, positive ratings improve conversion rates for both consumers and commercial buyers. Actively managing your Trustpilot presence shows a commitment to customer satisfaction and strengthens your reputation across audience types. For B2B transactions, third-party validation helps reassure buyers making large or recurring purchases — whether they're sourcing speciality parts or outfitting a fleet.

On-site testimonials.

Automotive businesses proud of their products and service can use on-site testimonials to highlight customer experiences, build credibility, and share real-world outcomes. While these reviews may not carry the same third-party authority, they remain valuable — especially when they showcase use cases relevant to both B2C and B2B audiences. Whether it’s a consumer describing a smooth installation or a repair shop highlighting fulfillment speed and part accuracy, testimonials help future buyers visualise success. These reviews also contribute to SEO value, since Google prioritises helpful, original content — including user-generated content. On-site testimonials reinforce your commitment to customer satisfaction and help build a strong brand identity across all buyer segments.

The final word

The automotive ecommerce market is accelerating, with sales projected to reach $267.8 billion by 2032. This growth spans both B2C and B2B channels, fuelled by mobile adoption, AI-driven tools, omnichannel shopping habits, and expanding digital marketplaces.

To stay competitive, automotive businesses must personalise the buyer journey, expand beyond borders, streamline operations, and deliver seamless experiences across every channel. Tools like AR, product configurators, and customer reviews help drive engagement and build lasting trust with every type of buyer.

With purpose-built features and flexible capabilities, BigCommerce empowers automotive brands — from parts retailers to B2B distributors — to simplify complexity, scale smarter, and succeed in today’s rapidly evolving market.

FAQs about automotive ecommerce

Nicolette V. Beard

Nicolette is a Content Writer at BigCommerce where she writes engaging, informative content that empowers online retailers to reach their full potential as marketers. With a background in book editing, she seamlessly transitioned into the digital space, crafting compelling pieces for B2B SaaS-based businesses and ecommerce websites.