About the App

We know tax isn't your primary focus. But it's getting more and more complex. Changing regulations and rapidly-evolving compliance requirements make it difficult for you to understand the implication of tax rules on your business. That's why we make it easy and efficient to meet your tax obligations, so you can get back to running your business. Our hybrid portfolio offers flexible deployment options, rapid time to value, reduced IT support, and continual development of new functionality and UX enhancements. By simplifying and streamlining sales and use tax calculation and reporting, we free you to get back to running, and growing, your business.

*Vertex is currently available for merchants based in the US and Canada.

Pricing

Custom Pricing:

Annual Fee with Vertex Cloud License

Information

Last Updated:

April 2, 2025

Compatible with:

CatalystMulti StorefrontDocumentation:

Installation GuideUser GuideResources:

Terms of ServicePrivacy PolicyPricing

Custom Pricing:

Annual Fee with Vertex Cloud License

Information

Last Updated:

April 2, 2025

Compatible with:

CatalystMulti StorefrontDocumentation:

Installation GuideUser GuideResources:

Terms of ServicePrivacy PolicyApp Features

Map Vertex product codes and classes for goods with special tax rates

Vertex centralizes all the rates and rules required for product taxability and accurate calculation of sales and use tax. No need to manage changing tax content manually. Let our research team stay on top of the latest tax changes, while you grow your business.

Map Vertex customer codes and classes for exempt or partially exempt customers

Collect, store, search and report on exemption certificates with ease. And provide your customers a self-serve online portal to simply answer a few questions and generate the required exemption certificates. Accurately manage exemptions on every transaction.

Generate tax returns or have Vertex file and remit on your behalf

Use Vertex technology to produce signature-ready returns in-house using the data from your calculation system. Or send us your data and outsource the entire compliance process to us. You'll spend less time on administrative tasks and refocus on more value-added work.

Embedded real time tax calculation and address cleansing within BigCommerce

No more manual calculations. Automate and standardize taxability and calculation on every sales and purchase transaction on every product in every jurisdiction with Vertex for BigCommerce. Improve your accuracy, reduce audit risk, and have confidence to grow your business.

Ensure every transaction has the proper tax jurisdiction assignment to trigger the accurate tax calculation rules. Each new address entered is automatically cleansed for errors and the full 9-digit zip code and Tax Area ID is assigned.

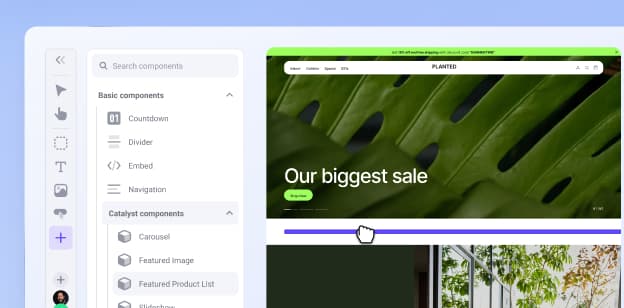

Simple connector setup through the BigCommerce one-click app store

No custom code needed. No customization of your BigCommerce environment needed. Simply configure your sellable products for proper taxability and Vertex manages address cleansing and accurate tax calculation on every transaction.

Customers who installed this app also installed

There are no slides

Build your online store with BigCommerce

Start your trial today