About the App

A simple tax management app that allows you to quickly set up custom taxes, duties and per-product flat rates that can be based on rules such as product SKU, categories, tax class, customer group, etc and then limited to specific areas by shipping zone and ZIP/postal code.

We offer full control to create federal, state and local taxes, levies, excises, per-product fees and goods taxes for a range of products and customers, including taxes that can apply to other taxes (e.g. duties). Completely compatible with Avalara (AvaTax and Excise Tax) for reporting, payments, other taxes and exemptions. Perfect for industry taxes, excise, fees and charges, as well as region-based tariffs and duties.

Pricing

Free Trial:

14 days

Upfront Fee:

$0

Recurring Fee:

$49/mo.

Information

Last Updated:

April 2, 2025

Compatible with:

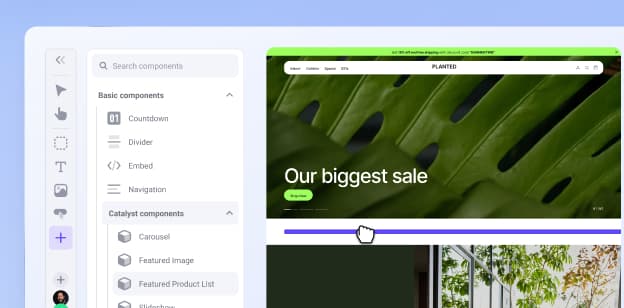

CatalystMulti StorefrontDocumentation:

Installation GuideUser GuideResources:

Terms of ServicePrivacy PolicyPricing

Free Trial:

14 days

Upfront Fee:

$0

Recurring Fee:

$49/mo.

Information

Last Updated:

April 2, 2025

Compatible with:

CatalystMulti StorefrontDocumentation:

Installation GuideUser GuideResources:

Terms of ServicePrivacy PolicyApp Features

Configure Rule-Based Taxes

Add custom taxes to your store and set them to apply based on conditions like product SKUs, ZIP/postcode, categories, customer group, region and more

Advanced Tax Values

Set up percentage-based taxes, per-product rates, fees, flat taxes, exemptions and taxes on the entire order total (inclusive of other tax values, like duties)

Display Tax Breakdowns

Aggregate rates together, and show customers the tax breakdowns for orders with tax inclusive items

Integrate with Avalara

Connect your AvaTax or AvaTax Excise API account to use Avalara's cross-region compliant taxes alongside other tax rates

Compatible with BigCommerce Basic Tax

Use your BigCommerce tax rates alongside Excise App rates, or apply them to the order total on top of the app's rates

Customers who installed this app also installed

There are no slides

Build your online store with BigCommerce

Start your trial today